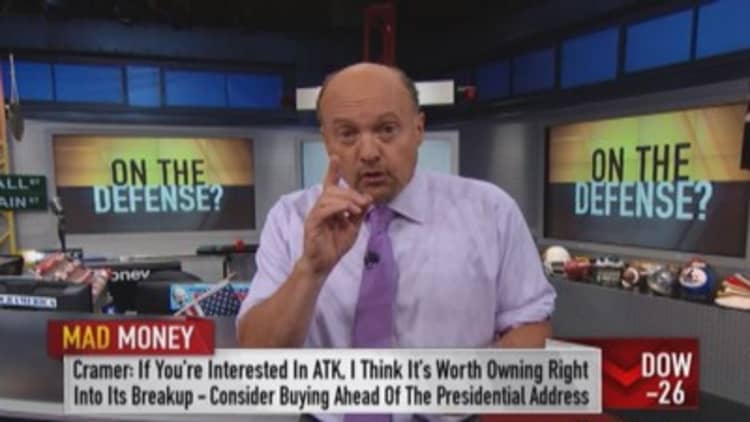

If you can move quickly, Jim Cramer thinks you should.

He believes certain stocks could make substantial gains, quite soon, and therefore he suggests establishing a new position now.

And by now, he means right now.

The "Mad Money" host is looking for a bullish catalyst as soon as Wednesday, in the form of the President's speech to the nation in which Mr. Obama is expected to pitch his plan to defeat , the successor group to Al-Qaeda in Iraq.

According to a story in the New York Times, which provided the spark for Cramer investment thesis, the Present is expected to tell the nation that the campaign could take as long as 3 years.

Given this development, along with the uncertainty in Russia, "I think one thing becomes very clear," Cramer said. "Our military spending is going to start increasing again because we're going to need a lot more missiles, more bombs, more tanks, and especially more bullets."

Although Cramer believe the recent acts of terror are unconscionable, he also says that Wall Street will view developments through the disciplined lens of an investor.

And pros will be keenly aware that, "when we enter into multi-year military campaigns, our defense companies make money. Therefore, I think you should do some buying before Wednesday's big Presidential address, especially since most of the defense contractors have been lagging the market for 2014 and they're much cheaper than the average stock in the S&P 500."

Following are stocks that Cramer would put on the radar.

"First and foremost, I like Alliant Tech, the maker of missiles, aerospace parts, and bullets," Cramer said.

Although the company is currently spinning off its sporting group, which makes ammunition for the non-military market, Cramer said he likes both parts of the company, and believes his bullish outlook is reflected in recent earnings.

"Alliant's last quarter, reported at the end of July, was very strong, with the company reporting a gigantic earnings beat on better than expected revenues, and that was before the administration had decided to really go after ISIS. Just imagine how well Alliant Tech might do once the Pentagon starts spending money aggressively again. I think you own this company right into the breakup."

If you're looking for a different idea, Cramer is also a buyer of Raytheon. "Raytheon's a leader when it comes to making high-tech defense hardware. This war against ISIS is going to be waged from the air, and Raytheon makes the tactical radar systems for our current generation of fighter planes, and I think it's likely they'll make the radar for the next generation bomber that the Pentagon's developing."

--------------------------------------------------------------

Read more from Mad Money with Jim Cramer

Jim Cramer's fantasy stock portfolio

Has nobody noticed elephant in market?

Deckers on brink of revolution?

--------------------------------------------------------------

In addition. Cramer added, "It's hard to go wrong with Lockheed Martin." However, if you're looking for significant upside, Cramer said it's important to note Lockheed has actually outperformed the S&P year-to-date, so it might not have as much upside as an Alliant Tech or a Raytheon. "Still, Lockheed's a terrific company with a history of consistently boosting its dividend, a gigantic buyback, and $3.4 billion in cash on the balance sheet."

(Click for video of this Mad Money segment)

Call Cramer: 1-800-743-CNBC

Questions for Cramer? madmoney@cnbc.com

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com