The prospect of Scottish independence, discounted by the markets for months, has all of a sudden become so worrying it might drive traders to a wee dram of Scottish whisky.

Much of the concern has been focused on the potential impact on sterling and Scottish-based U.K. companies.

It's not in anyone in the U.K. government's interest to have an economically crippled Scotland, so a "velvet divorce," with concessions to continuing support of the country's banks, is more likely than the threatened currency upheaval. Yet, with a "basic failure to prepare for the economic and constitutional consequences of an independent Scotland" (according to Oliver Harvey, currency strategist at Deutsche Bank), the U.K.'s elite has been caught napping.

Here, we take a look at the likely consequences from the economics and business perspective.

UK politics

This is what is really panicking markets – the potential derailment of the established order in the U.K.

The Labour and Conservative (Tory) Party have traded power for decades, and as both have become more centrist in recent decades, there has been general political stability.

With Labour's 40 Scottish MPs out of the picture, the Tories should be guaranteed dominance for generations. Yet this might make it more likely that the U.K. leaves the European Union, a policy increasingly popular with the party's grass roots. Prime Minister David Cameron's personal standing would also be damaged by his government's failure to win this referendum.

With Labour a spent force, the increase in support for the U.K. Independence Party, which appeals to some of the older Labour supporters, might take off.

The general election planned for May 2015 could be shelved until after Scottish independence, expected in March 2016.

Currency

The argument over whether an independent Scotland could keep the pound has been raging for months. Despite U.K. government protests to the contrary, a currency union with fiscal links to the Bank of England is being talked about. The big risk with this option is that both the rest of the U.K. and Scotland are still vulnerable to each other's economic weaknesses, much as Germany was with Greece during the euro zone crisis.

Scotland could also bring in its own currency, pegged to the pound, after a period using sterling but not having its own central bank.

Sterling has risen in recent months as traders bet that the Bank of England would become the first major central bank to raise rates. Scottish independence could derail that, with Nomura forecasting a potential 15 percent plunge in sterling against the dollar in the months following a Yes vote.

Companies

U.K. equities might actually benefit from stronger foreign sales if a Yes vote leads to weaker currency, as close to 75 percent of sales/revenue for U.K.-listed companies comes from abroad, analysts at Citi have pointed out.

There is likely to be a pause in investment in Scotland while the details of independence are thrashed out in Westminster.

Tax

This is one of the areas where the Yes campaign has made a strong economic case. Scotland could cut corporation tax to attract more investment from the kind of companies who have been relocating to Ireland for tax purposes. With the similar attractions of a population which is English-speaking, well-educated but cheaper to employ than Londoners, a lower tax rate might make companies do a double Scotch rather than Irish.

Balancing the books

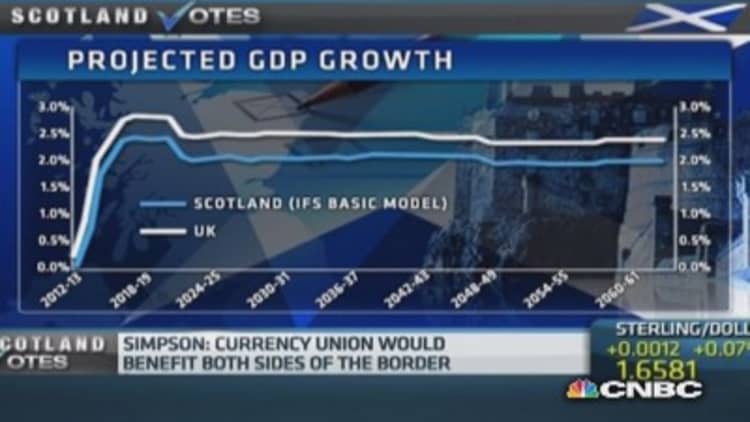

An independent Scotland would start life with a deficit of 6.4 percent of GDP, if some of its biggest companies followed through their threats to relocate, according to the Centre for Economics and Business Research, a London-based think tank. This contrasts to 4.4 percent for the U.K. as a whole last year.

However, it would benefit from a projected 90 percent of the tax take from North Sea oil and gas revenues – although this is a rapidly declining resource.

There are also early signs that unemployment figures could be affected in Scotland, with recruitment agency Manpower reporting that fewer businesses are looking to hire north of the border.

To EU or not to EU?

An independent Scotland would have to re-apply to join the EU ahead of divorce from the U.K. in March 2016, so would have to meet the same criteria as other states. This would be one of the key priorities of the 17-month gap between a Yes vote and actually leaving the U.K. Scotland may face opposition from Spain, facing similar problems in its Catalonia region.

Bank downgrades

Both Lloyds (which bought the former Halifax Bank of Scotland) and Royal Bank of Scotland, the banks bailed out by the U.K. taxpayer, are Scotland-based at the moment – and transferring those liabilities to a new Scottish government would be crippling. However, this alarming prospect has already been dismissed through gritted teeth by the U.K. government, and the Bank of England will likely have to continue to provide liquidity to these banks.

Still, both banks were amongst the biggest fallers in London Monday, on concerns about greater uncertainty in the U.K. generally. On closer inspection, the picture may improve. The cost of lost earnings and changing their tax domicile to London for Lloyds and RBS should be just 2.5 to 4 percent on the stocks, according to Bernstein.

Rule Britannia

The Queen would stay as Scotland's head of state – but, if there was a groundswell of anti-monarchical feeling following the country's secession, retaining her as the head of state could be put to the vote.

- By CNBC's Catherine Boyle. Twitter: @cboylecnbc