If Bill Gross still can be called "the bond king," then there's at least a significant amount of tarnish on the crown.

While the Pimco founder's stunning departure from the bond giant—the firm he founded 43 years ago—may ease his personal stress load, it does little to burnish his image.

In going to Janus Capital Group, Gross will manage a fund at a firm less than one-tenth the size of his old company. He leaves amid a trail of embarrassing headlines, weak performance and huge investor outflows. That's not to mention a swirl of reports that he was about to be fired for erratic behavior.

For the markets, then, the question turns to who will be the next to wear the crown of bond king. At 70 years old, Gross was in the waning days of his reign anyway, but the move announced Friday puts a bit more urgency to see who will be his successor not only at Pimco but also as a widely followed voice in the broader fixed income market.

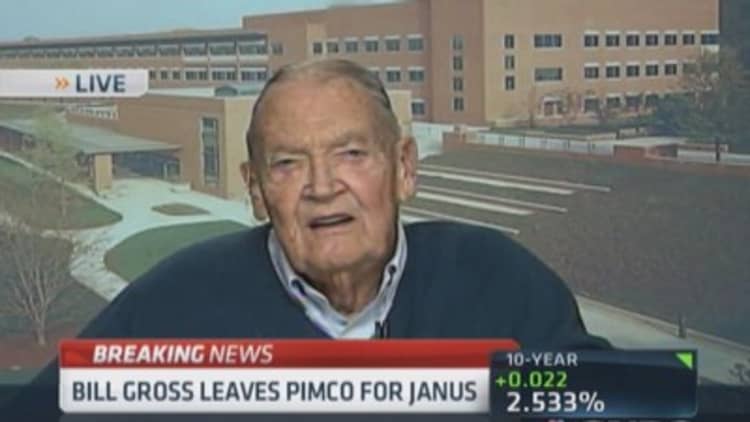

"He's a true giant in the industry, he's a true legend. He's earned all of that," Vanguard founder Jack Bogle told CNBC. "There aren't a lot of people in my field who currently measure up to that test."

Read MoreGross' departurefrom Pimco is shocking: Bogle

Finding a replacement figure won't be easy, he added.

"He's the real thing in an industry based ... largely on illusion," Bogle added. "Obviously, it's not going to be good for Pimco's business."

For the firm itself, the replacement, expected to be named Friday afternoon, will come down to a committee of six co-chief investment officers who were brought on earlier this year to spread around the power balance at Pimco.

Daniel J. Ivascyn was mentioned most often as the front-runner by bond traders interviewed by CNBC.com. The other CIOs in contention are Andrew Balls, Mark Richard Kiesel, Scott A. Mather, Virginie Maisonneuve and Mihir P. Worah. Former Pimco CEO Mohamed El-Erian is said to not be interested in returning to his old firm, though he currently works for parent company Allianz.

Read MoreDan Ivascyn likely Bill Gross successor: Report

As for the person likely to inherit the more colloquial reputation as bond king, that gets a little trickier.

The name most often mentioned is Jeffrey Gundlach, head of $52 billion DoubleLine Capital.

Gundlach is the bond market's current hot hand after he was pretty much alone in predicting that U.S. government bond yields actually would decline this year, despite a growing economy and the Federal Reserve stepping away from its historically aggressive monetary easing policies.

Read MoreGross met with Gundlach to discuss joining Doubleline

A representative for Gundlach said he's not commenting yet on Gross' departure. CNBC reported Friday that Gross asked Gundlach if he could join him at Janus.

Read MoreGrossexit ripples through bond market

However, the title of "bond king" may be a dubious one during a time that is likely to be trying for fixed income.

"The bond bull is dead," said one bond trader who spoke on condition of anonymity. "Gross going out now is just another thing that I put in my little journal. It's part and parcel of that secular change. I wouldn't want to be the king of a deteriorating empire."

Indeed, Gross' departure seemed to cast an additional pall over the bond market as the Fed prepares to end its monthly bond-buying program and ultimately start raising interest rates.

"I wonder how much all of this is related to the problems in the financial markets that still haven't really been cleaned up since the financial crisis," said Kim Rupert, managing director of global fixed income analysis at Action Economics. "There are just a lot of tentacles out there that could portend some problems."

More immediately, the days ahead will pose a challenge to Pimco's status atop the bond market. The Total Return Fund, despite 15 consecutive months of outflows, remains atop the fixed income world with its $221.6 billion in assets under management.

Morningstar placed all the Pimco securities under watch Friday pending how the firm acts to replace Gross and adjust its business activity.

"You're likely to see flow activity from Pimco broadly," said Michael Herbst, Morningstar's director of manager research for active strategies. "Watching (fund flows) would be pretty key, because if outflows pick up that has bigger implications for Pimco as a firm."

Herbst said that the appointment of the co-CIOs was a strong indication that Pimco was getting ready to make a change. However, he expected Gross to say for another three to five years and said he was surprised by Friday's announcement.

"Pimco is not a one-person show," he said. "Obviously, Bill Gross has a big imprint on the firm's culture and on the firm's investment process. But you've got a deep bench with strengths across all areas of the fixed income market."