Spot gold pared losses on Wednesday after the Federal Reserve released minutes from its September policy meeting.

``The concern was raised that the reference to 'considerable time' in the current forward guidance could be misunderstood as a commitment rather than as data dependent,'' said the minutes of the Fed's Sept. 16-17 meeting, which were released on Wednesday.

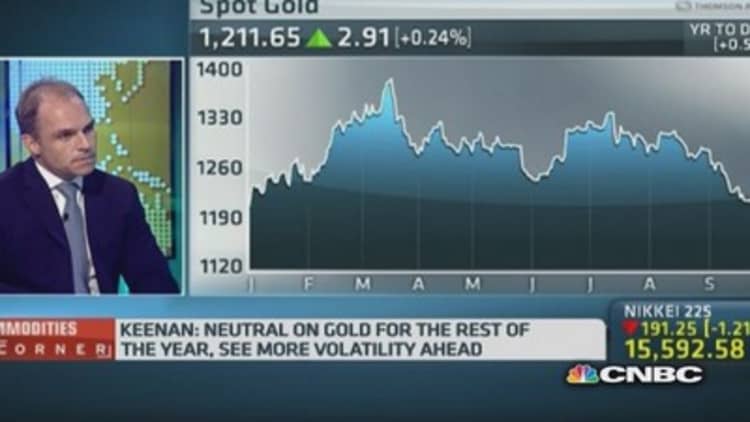

rose 0.5 percent to $1,215 an ounce. The metal dropped to $1,183.46 earlier in the week—its lowest since June 2013. U.S. gold futures settled $6.40 lower at $1,206.00 an ounce, but rose modestly after the announcement.

'Weak and uneven': IMF cuts global growth forecast

Gold is well-bid as stocks fell after the International Monetary Fund cut its global economic growth forecasts for the third time this year on Tuesday, warning of weaker growth in core euro zone countries, Japan and big emerging markets like Brazil.

Equities were also hurt as German industrial output fell far more than expected in August, posting its biggest drop since the financial crisis in early 2009, the latest figures to raise question marks about Europe's largest economy.

"Despite a pause in the recent sell-off for gold and the possibility of a short covering rally, the bullish outlook on the dollar is likely to constrain any potential bullion rallies," HSBC analyst James Steel said.

The dollar has gained in recent weeks on speculation that the Federal Reserve would raise interest rates sooner and faster than expected.

Read MoreSeasonal demand unlikely to help gold amid strong dollar