Can you own too many stocks? Absolutely.

If you're an individual investor trying to make your way in the stock market you may be tempted to hold a large number of stocks.

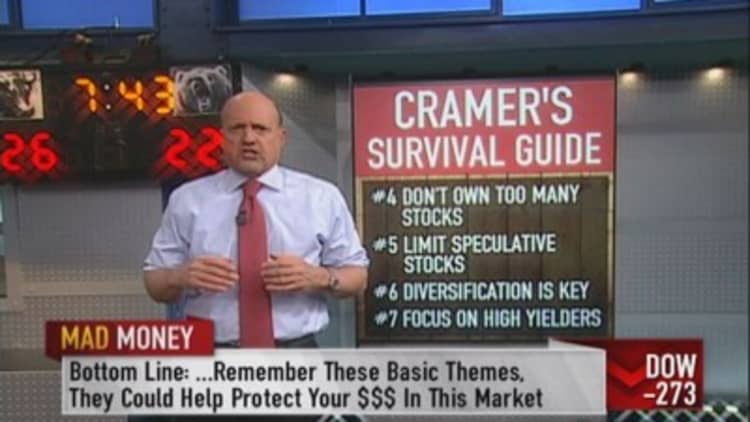

Jim Cramer, as well as other market pros, always talk about diversifying risk and what better way to do that, than by owning a wide range of stocks.

However, diversification and owning a large number of stocks aren't the same thing.

"Unless you're running a mutual fund, there's no reason to own a large number of stocks," the "Mad Money host said. Instead, "I want you to hold between five and 10—but not more than 10—high-quality, diversified names."

Largely Cramer thinks if you hold more than 10, you won't be as informed as you need to be to succeed. "More than 10 and you will likely start skimping on the homework, and that's incredibly dangerous," Cramer said.

By homework, Cramer means the research that's necessary to keep yourself abreast of all the catalysts in the market that can move the stock. It involves examining earnings reports, reading news stories, and parsing through Wall Street analysis.

And that's time consuming.

"Homework means committing one hour per week per stock," Cramer said. "Much less than that, and you might as well be gambling." And few people can commit more than 10 hours per week.

"Therefore, I say you can't handle 30 stocks, even 20 is like having a part-time job. Ten, however, is just right," Cramer said.

--------------------------------------------------------------

Read More from Mad Money with Jim Cramer

Broke, Cramer had this financial epiphany

Top stock picking secret, revealed!

Cramer's first fling with stocks

--------------------------------------------------------------

In addition, there's another tenet of trading the Cramer advocates: Don't own too many low dollar stocks at once.

Cramer recognizes it can be tempting to speculate on these relatively inexpensive stocks, the upside may be significant and you can buy 100 shares for a relatively affordable amount of money. Nonetheless, Cramer thinks spec stocks such as these should only be a small part of the portfolio. "They keep you engaged, but largely when a stock falls below $10 it's a signal the company isn't doing well."

Call Cramer: 1-800-743-CNBC

Questions for Cramer? madmoney@cnbc.com

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com