The dollar index rose on Wednesday after the Federal Reserve ended its monthly bond purchase program and signaled confidence the U.S. economic recovery would remain on track despite signs of a slowdown in many parts of the global economy.

The dollar index rose 0.6 percent after the announcement, having slipped on Tuesday.

Over the past couple of weeks, a recovery in global equities and investor risk sentiment has weighed on the Japanese currency, helping the dollar bounce back from a one-month low near the 105.19 touched in mid-October.

``The Fed's announcement is exactly what everyone expected. The Fed sees enough improvement in economic activity to end QE, but at the same time, it will keep low rates because it isn't yet seeing what it wants to see as far as inflation goes. That's what everyone expected. Policy is still very accommodative," said Wayne Kaufman of Phoenix Financial.

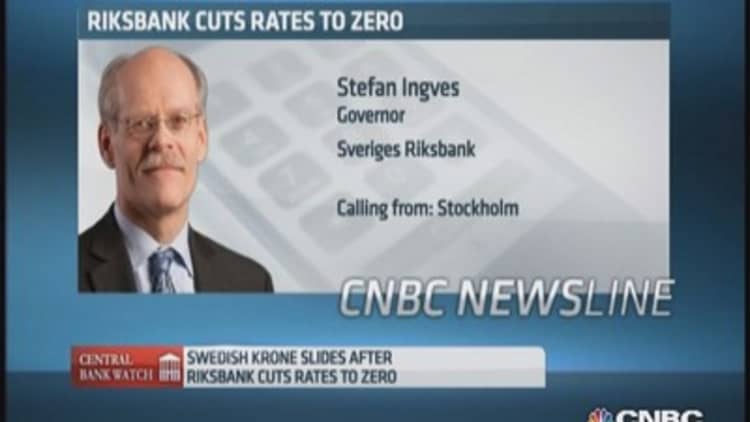

Earlier, the Swedish crown stabilized after sliding to four-year lows on Tuesday, dented by a surprisingly dovish message from Sweden's central bank.

The Riksbank cut interest rates more than expected to zero and said it would delay tightening policy until the middle of 2016 as it moved to tackle the risk of deflation.

Both the euro and jumped to four-year highs of 9.3912 crowns and 7.3824 crowns on Tuesday as a result of the rate cut. They have since steadied at 9.3490 and 7.3454.

Read MoreSwedish central bank cuts rate to zero to fight deflation

"In our view, the Riksbank's dovish forward guidance has pushed the SEK (crown) into the FX funding currency club, alongside the euro, the Swiss franc and the yen," analysts at BNP Paribas wrote in a note to clients. "We expect the SEK to underperform higher-yielding currencies during times of healthy and improving risk appetite."

The euro held steady at $1.2735, near a one-week high of $1.2765 set on Tuesday. Traders said big option expiries in the $1.2700-25 area could keep the common currency tethered in the near term.