Stocks weakened and bonds sold off Wednesday after the Fed surprised Wall Street with a slightly more hawkish tone that suggested it may be more aggressive with rate hikes than markets had expected.

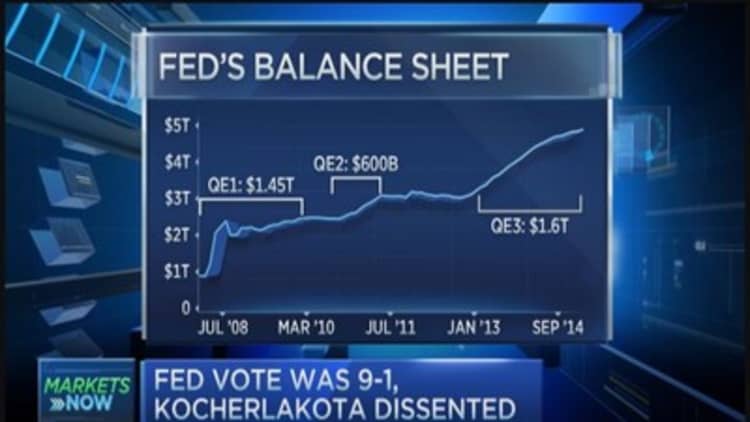

Without surprise, the Fed ended its quantitative easing bond-buying program. But it also tweaked the language in its statement to show that it saw improvement in the economy, and it did not mention signs that it saw economic contagion.

Specifically, it said there has been "substantial improvement" in the jobs outlook and the underlying strength in the broader economy. It also said inflation has been held down by lower energy prices and other factors.

"Maybe we brought forward the (first rate) hike a month or two from where it was yesterday," said David Ader, chief Treasury strategist at CRT Capital. Wall Street has been pricing in a fourth quarter rate hike, despite Fed forecasts of a midyear hike.

Stocks initially fell sharply, then reversed much of the losses before tumbling sharply again. By the market close, stocks were just slightly lower with the Dow off 31 at 16,974, at and the S&P 500 down 2 at 1982.

The Treasury yield curve flattened, as short-end yields rose relatively faster than those at the long end. The 2-year note yield moved from 0.44 percent to 0.49, and the 10-year was as high as 2.36 percent before returning to 2.32 percent. The flattening curve signals expectations of rising rates.

While the Fed language change surprised markets, it also kept in the line that it would keep rates low for a "considerable time."

"It's a little more hawkish than people thought," said John Canally, economist and market strategist at LPL Financial. "No mention of the global growth scare. No mention of tighter financial conditions."

Canally said the changes were significant for a Fed statement that was not accompanied by a press briefing, so that Fed Chair Janet Yellen could explain the changes.

"I thought it was clearly a more hawkish tilt on the part of the Fed," said Zane Brown, fixed income strategist at Lord Abbett. "The Fed did feel better about the economy and inflation going back up to 2 percent."

Brown said the big changes were in the phrase where the Fed described the labor market. It said "underutilization of labor resources is gradually diminishing."

As a result, the market's rate hike expectations moved just slightly, with fed funds futures rising slightly for December 2015.

"The dollar will strengthen and rates are likely to rise because the Fed now thinks they are on the schedule they identified at their September meeting. They still think they can do what they suggested and start raising rates in mid-2015 and get to 1.38 by year-end," said Brown.

The 1.38 is the median expectation of Fed officials for the end of 2015, and the market, meanwhile, is pricing the fed fund futures for December 2015 well below that—at 0.52, said Brown. That was above the 0.45 rate priced in before the Fed statement, he said.

"I think the stock market will be fine but I also find the Fed's comments to be more hawkish. I think the Fed is realizing that they've basically called the labor market wrong," said David Kelly, chief global strategist at JPMorgan Funds.

"Even at a moderate rate of growth, this labor market is tightening up fast. I think the key to whether we get a rate increase as early as March is—what do wages do from here?" Kelly said.

"Our research suggests that when unemployment falls below 6 percent and then declines from there, that's when you get wage gains. If we see wages pick up I think we'll see the Federal Reserve move further, toward the hawkish side. I don't think the bond market is priced for what the Fed is going to do next year."

Canally said he expects the first rate hike is about a year away. He said the list of indicators the Fed watches still shows plenty of problems with the labor market, including slow wage growth and the problems with long-term unemployment.

Read More Market pushes back Fed rate hike expectations: Survey