U.S. indexes looked set to open slightly lower on Tuesday, with tumbling oil prices weighing on Wall Street futures and global stocks.

Brent crude and WTI crude oil prices continued to decline on Tuesday, after Saudi Arabia cut export prices to the U.S. but raised them to Asia and Europe. There are no signs that the Organization of the Petroleum Exporting Countries (OPEC) will curb output, as it is reluctant to cede market share to the U.S.

Shares of European oil supermajors fell on Tuesday, with BP and Royal Dutch Shell down over 1 percent, and Total slipped around 2 percent. Chevron and Exxon Mobil are likely to take a hit when Wall Street opens, having declined on Monday.

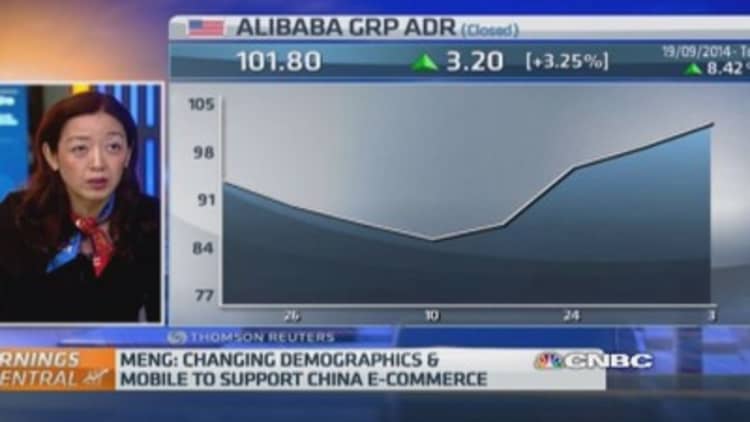

Alibaba's first quarterly results had the Chinese e-commerce company reporting earnings in line with expectations but revenue beating estimates. Its shares were near unchanged in early New York trading.

Other companies reporting before U.S. trade starts include ArcherDaniels Midland, Burger King, Discovery Communications, Michael Kors, TransCanada, Valero Energy and Intercontinental Exchange.

Activision Blizzard, 21st Century Fox, Devon Energy, Liberty Media and FireEye report after Wall Street closes.

Tuesday's economic reports had the September trade deficit at $43.03 billion, compared to expectations of a $40.0 billion gap.

There will also be data on U.S. factory orders at 10 a.m.