If you believe the so-called Doctor Copper theory, the diagnosis for stocks is not good.

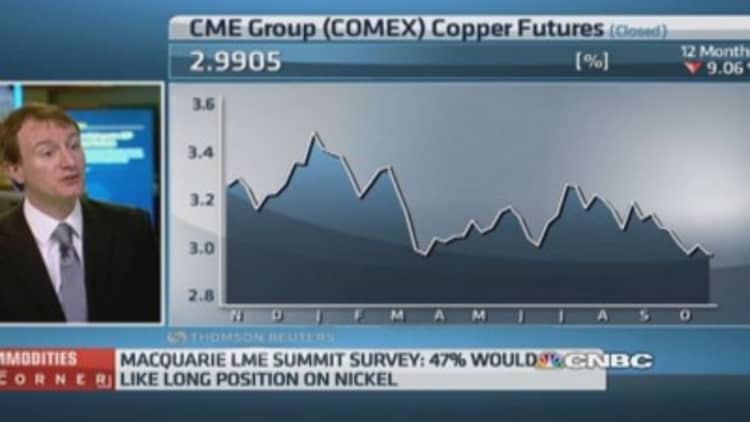

Copper futures plunged to a 4½-year low Sunday evening, before staging a bit of a resurgence Monday. But with the industrial metal down 9 percent in the past three months, the "Doctor Copper" theory has become a warning, for some, about where stocks are going.

A time-honored concept in markets, the theory holds that copper is able to sense economic turning points early, and thus measure the health of a stock market rally. This is because copper is a near-omnipresent metal used in homes, in electronics and for many industrial purposes. The idea, then, is that if copper prices are falling, economic activity is slowing down, which is bad news for other financial assets.

Read MoreGold rebounds 2.6% after early slump on Swiss vote

"Because copper has so many industrial uses, it's probably a great indicator," said metals guru George Gero of RBC Capital Markets, so falling copper prices should indeed cause concern.

Still, Chris Kimble of Kimble Charting Solutions notes that copper has been falling for years, even as equities have skyrocketed.

"Over the past two or three years, if you followed copper, you would have missed the S&P rally," Kimble pointed out.

Kimble said that copper has thus far managed to hold an important support line that it tested in 2002 and 2009. If it breaks below monthly support, which currently lies at $2.75 per pound, he would become concerned about equities. By early afternoon Monday, March copper futures up 1.8 percent to $2.90.

"To send a negative message, you'd have to see that line break," he said.

For others, the fact that stocks have continued to surge even as copper prices have declined tells us that the global economy is shifting its weight.

Michael Block of Rhino Trading Partners acknowledges that copper is indeed sending a dour message about global growth, which is a "bad sign for capital goods, building, etc." But he suggests that the world is not as reliant on construction and industrial production as it used to be, particularly as the Chinese economy has developed.

"The doctor is not what he was in 2006 to 2008," he wrote to CNBC. "The world has changed. The next leg of Chinese growth won't come from the investment side of the GDP equation, but from the consumer side. That means using copper as a one-factor model may not work."

"It is worrisome? Sure," Block added. "Do we also risk focusing too much on one thing? Yes."

Watch "Futures Now" Tuesdays & Thursdays 1 p.m. ET exclusively on FuturesNow.CNBC.com!