Investors had reason to be excited when they learned of the offer last week of new guarantees on retirement savings.

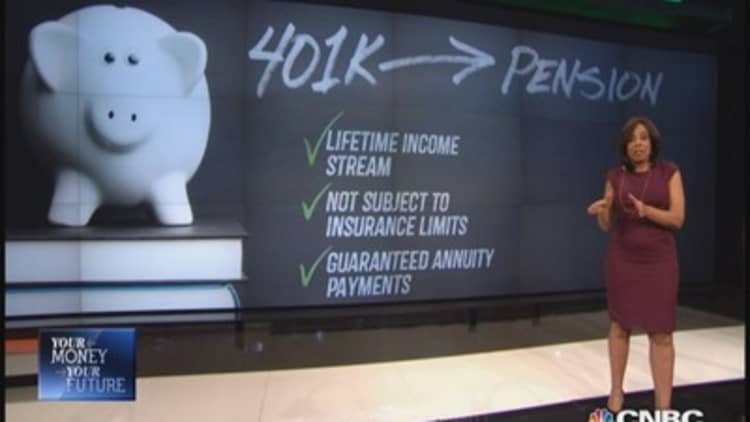

After all, anyone who watched their 401(k) balances shrink during the financial crisis can remember fearing that a key retirement safety net might disappear. The news that the Pension Benefit Guaranty Corporation, or PBGC, will guarantee assets that savers roll over from 401(k) accounts to certain defined benefit plans seemingly provides a safer alternative.

"It's really a recognition of the state of retirement for most Americans and the desire to be able to provide a nice wrapper, a guarantee, around pension benefits," said Janet Stanzak, president of the Financial Planning Association. The move, she said, acknowledges that "a lot of individual investors do not necessarily manage their 401(k) or IRA assets well, and those assets could well run out in their early retirement years."

Read MoreGovernment guarantees 401(k) rollovers into pensions

But while the new guarantees sound promising at first, experts say their potential impact is less so. Companies may not open up the relevant options to their employees, and employees themselves may decide that the new guarantees come with unappealing conditions.

"It's a worthwhile idea, but I'm not sure how much traction you are going to get," said Robyn Credico, defined contribution practice leader at the consulting firm Towers Watson.

Pension rule change has limited reach

Many employers will not even have to consider the new guarantees, since they only apply to companies with both defined benefit plans that have been terminated and are now managed by the PBGC, and a defined contribution plan, according to a spokeswoman. She added that the PBGC does not publish data on the number of companies in that situation, but according to Towers Watson, just 2 percent of the 2013 Fortune 500 employers have terminated defined benefit plans since 1998.

While companies with both defined benefit plans and defined contribution plans like a 401(k) have had the option to let employees roll funds over in the past, albeit without a government guarantee, few have done so, Credico said. One reason was because employers had to cover PBGC guarantees, she said.

Credico added that at the few employers she knows that have been offering the conversion option already, "even their employees haven't been taking advantage of it." Employees tend to want the option to take their 401(k) money all at once when they retire, whether to consolidate accounts or to invest it themselves, and they seem to resist handing investment decisions to someone else.

Plan for retirement income

Policymakers have been trying to encourage savers to put some retirement savings into annuities, since the steady payments reduce the risk that retirees will run out of money. The Treasury Department in October said it would alter its retirement funds policy to allow employers to use target–date retirement funds as a default investment option.

Read MoreAnnuities for retirement: good or bad idea?

But employees saving for retirement do not seem to be big fans of locking into fixed payments with 401(k) assets. Credico said "the vast majority" of people retiring with 401(k) assets seem to prefer receiving the money in a lump sum rather than rolling the money into annuities and the like.

"With 401(k)s, people almost never keep them," said Andrea Blackwelder, co-founder of Wisdom Wealth Strategies, a financial planning firm in Denver.

Blackwelder offered several ideas to consider for employees mulling the new guarantee option. First, think about your likely life expectancy. If your parents are still alive and healthy in their 90s, that increases the odds that you will have a lengthy retirement, and possibly a greater need for guaranteed payments.

Consider also the needs of your survivors, Blackwelder said. Different employers offer different options in terms of extending defined benefit pension payments to spouses. Also, be honest with yourself about your liquidity needs. If you roll all of your retirement assets into a plan that only allows fixed payments, you may not have enough money to fall back on in an emergency.

Read MoreTaking a loan from yourself

Blackwelder also recommends comparing the terms of the defined benefit plan to the annuity options offered by insurance companies. Many of those come with hefty fees, she said, but it can pay to look.

"We started out thinking the marketplace would be dominated by defined benefit plans," Stanzak said. "Now we've swung the pendulum so far the other way that retirees no longer have that retirement annuity income. Now all of a sudden we see the pendulum swinging back somewhat. I think that's a good thing."