The much better-than-expected November jobs report signals an economy that's really starting to accelerate, analysts told CNBC on Friday, just after the numbers were released.

They also said the strong government labor numbers might give the Federal Reserve ammunition to start raising interest rates in the middle of next year after all.

Read MoreHappy holidays! Job creation jumps in November

Former Minneapolis Fed President Gary Stern said he sees mid-2015 for the first rate hike, but he thinks the central bank does have flexibility because inflation is so low.

Kevin Hassett, Mitt Romney's former economic adviser, said the Fed could tighten even sooner than summer.

Austan Goolsbee, former chairman of President Barack Obama's Council of Economic Advisers, told "Squawk Box" that three months more of job growth like November and economists will really start to change their tune.

Moody's Analytics Chief Economist Mark Zandi, who compiles the month ADP private-sector jobs report, said the government's employment report was a boom number. He pointed out that wage growth is also accelerating.

The initial drop in U.S. stock futures after the report didn't surprise Brian Belski, chief investment strategist with BMO Capital Markets.

He said investors remain "very reactive" and short-term focused, especially since many portfolio managers have been underperforming this year.

Belski reiterated his call on "Squawk Box" last month that the stock market is 5½ years into a 20 year bull market.

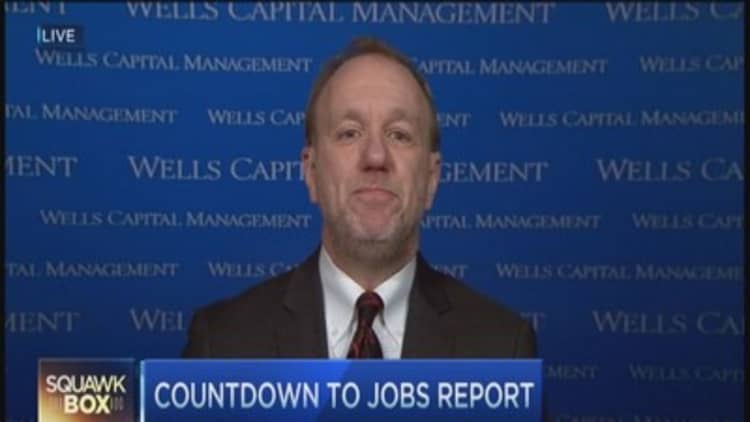

Before the release of the jobs number, James Paulsen, chief investment strategist at Wells Capital Management, told CNBC he's a little concerned about what may happen next year.

Paulsen has been riding the bullish wave that's taken stocks to new highs this week. But he's looking for a flat 2015 because of how far stocks have come and the widespread optimism.