Russia may be among the worst hit by the decline in oil prices, but analysts say clean living may keep government finances on an even keel. Its corporate debt may be another matter.

"The sharp decline in oil prices and the value of the ruble do not significantly reduce the creditworthiness of Russian sovereign debt, at least not in the near term," Wells Fargo Securities said in a note last week. "The government's debt-to-GDP (gross domestic product) ratio is relatively low, and the debt-servicing requirements of the dollar-denominated portion of the debt stock are manageable over the next few years."

Read More Can Russia do anything to stop the ruble's slide?

While data from the International Monetary Fund indicates the government gets around half its total revenue from petroleum, the ruble's plunge has paced the decline in the price of oil, offsetting the impact when dollar-denominated oil sales are translated back in the local currency, Wells Fargo noted.

Since this summer, Brent crude oil has fallen from above $115 per barrel to around $61.08 a barrel in Asian trade Monday, with many analysts predicting prices will continue to slide. At the same time, the around 70 percent since the end of June, with the U.S. dollar fetching around 58.2 rubles Friday.

Government debt not a worry

Only around $38 billion of Russia's government debt is denominated in dollars, and of that amount only around $6 billion of interest and principal payments are due in 2015, compared with around $400 billion of foreign-exchange reserves, Wells Fargo noted. With around two-thirds of government debt borrowed in rubles, the central bank can theoretically create enough rubles to pay off those creditors, the bank said.

Read More US Congress readies new sanctions on Russia

Obviously, that creates inflation risks. The cost of Russia's borrowing has climbed recently, with its 10-year ruble-denominated sovereign bond yield around 13.00 percent Friday compared with 8.33 percent at the end of June, according to Reuters data.

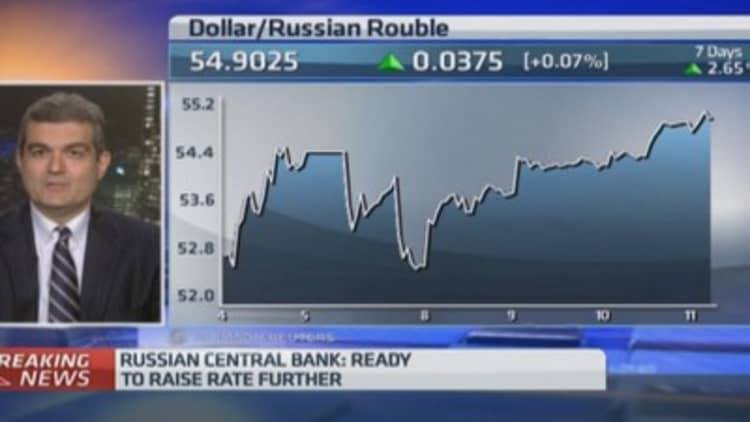

Russia's central bank raised its main interest rate by 100 basis points to 10.5 percent on Thursday – the latest in a series of hikes this year as it attempts to rein in inflation and bolster the country's struggling economy, which also faces headwinds from sanctions from the West due to its conflict with Ukraine.

Credit Suisse Private Banking echoed the relatively sanguine view on Russia's sovereign debt risks, adding it expects the country's current account surplus will rise in 2015 on a combination of weaker domestic demand and the ruble's decline. In a note last week, Credit Suisse said it has a positive view on the country's sovereign hard-currency bonds on attractive valuations, but it is more cautious about buying into the local-currency ones.

Corporate debt concerns

Both banks expressed concern over Russian corporate debt.

"Any Russian company or bank that needs to service foreign currency debt would have a more difficult time making foreign currency debt servicing payments if it does not generate revenue that is denominated in foreign currency," Wells Fargo said, noting the ruble's decline also lowers corporate net worth.

Read More Why India and Russia remain BFFs

Russian companies owe about $160 billion in intercompany debt to overseas parents and subsidiaries, likely mostly to Western European companies, while Russian banks have around $200 billion of external debt and other sectors have around $300 billion, Wells Fargo said.

Credit Suisse is also concerned, expecting the country's corporate bonds will remain volatile, with high risk premia.

"The Russian credit curve has inverted sharply, as near-term default risks are perceived to rise alongside the weaker oil price," Credit Suisse said, adding that sanctions are also weighing on the outlook for these assets.

Read More Russians are buying American—while they can

"Although we still see positive GDP growth in Russia for 2015, the Russian banking sector is likely to suffer from rising bad loans, due to the weakening macro backdrop for both corporates and households in Russia," Credit Suisse said.

However, many major banks are government-controlled or majority state-owned and the state is likely to offer protection, the bank noted.

—By CNBC.Com's Leslie Shaffer; Follow her on Twitter @LeslieShaffer1