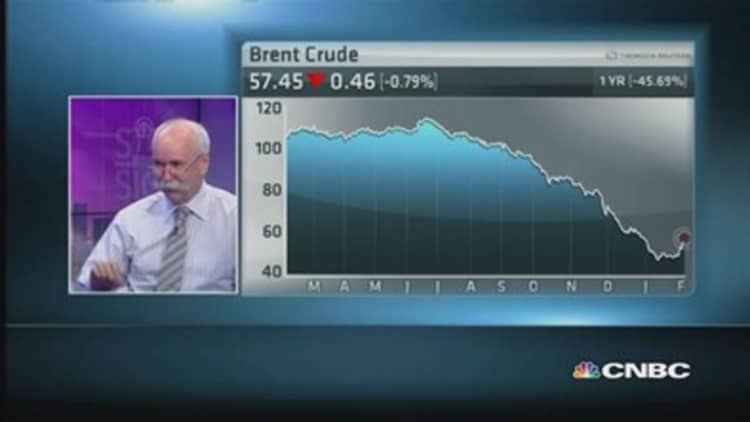

Oil prices have rallied off their post-crisis lows, in a move that may mark the bottom of the rout as producers' cutbacks begin pinching supply, some analysts said.

"We've seen the lows for the year," Daniel Morgan, global commodity analyst at UBS, told CNBC, citing producers' steps to decrease counts and aggressively cut capital spending. "Financially, the oil price just got sold off too aggressively and so was poised for a comeback."

He doesn't believe Brent at around $59 a barrel is "appropriate" on a longer-term view, adding it's still an attractive entry point at current levels.

Read More Oil expert: This is a 'dead cat bounce'

U.S. oil climbed was down slightly on the day at $51.23 after trading as low as $43.58 last week, its lowest since mid-2009, during the Global Financial Crisis (GFC). rose as high as $59 a barrel in Asian trade Wednesday before retreating to around $56.32. Last month, Brent had traded as low as $46.40, plumbing levels last seen during the GFC. Prices had fallen as much as 60 percent since June of last year.

Rig counts

Morgan isn't alone in calling the start of a recovery.

"Oil prices will recover this year and average $60 a barrel for Brent," Nomura said in a note Monday, citing comments from oilfield-service company Baker Hughes on North American rig activity.

The bank expects the region's rig counts may fall another 30-40 percent this year, with similar capex cuts among customers.

Baker Hughes reported last week that 90 rigs were deactivated over the previous week, possibly the largest number cut since record-keeping began in 1987. BP also said it would cut its capex by 13 percent this year.

Read More BP's Dudley: Oil may stick at $50 'for some time'

"Oil production in the shale basins will inevitably decrease as weaker, higher-cost producers shutter their operations," Nomura said, estimating a 15-20 percent drop in U.S. production would eliminate the global oversupply. It also sees upside price risks from disruptions in places such as Russia and Libya.

It advises buying select stocks in the sector, such as those exposed to operating expenditure rather than capex, as they could start rallying before oil prices do.

Too early to call a bottom?

To be sure, some do think the oil price rally has run its course.

Oil is just finding its new equilibrium after the market tested how responsive shale producers would be to the sharp decline, Mizuho said in a note Wednesday.

"The sharper-than-expected pullback of U.S. rigs mean that the new equilibrium oil price to balance supply cuts with current demand is probably higher than the lows we have seen in January," Mizuho said. That means oil is more likely to stabilize, it said.

"A buildup in oil inventories also suggests that near-term demand is too soft for oil prices to stage another rally higher back towards $70 levels," Mizuho said.

Last week, U.S. oil inventories rose by 6.1 million barrels to 411.2 million barrels, after rising 12.7 million barrels the previous week, according to data from the American Petroleum Institute.

Fast rise?

Even UBS' Morgan isn't advising going to town on oil's rally.

"We do still have a physical market surplus that's going to be sloshing around in the market for the next 12 months or so," Morgan said. "Oil's not going to go back to $90-$100 in a heartbeat. But in the longer term, I think it will go back to $80 in a two to three year view."

Some, however, do expect a quick return to higher oil prices.

"Supply will shrink more rapidly than expected and demand will increase faster than expected," Thierry Apoteker, executive chairman at TAC Economics, told CNBC, citing the economic recovery in the U.S. as driving increased demand. He forecasts Brent to rise all the way to $70 a barrel in the first quarter and to reach $90 later in the year.

--Matt Clinch contributed to this article

—By CNBC.Com's Leslie Shaffer; Follow her on Twitter @LeslieShaffer1