Globalization used to be the big buzzword in Corporate America, with many large companies boasting about expanding their worldwide footprints.

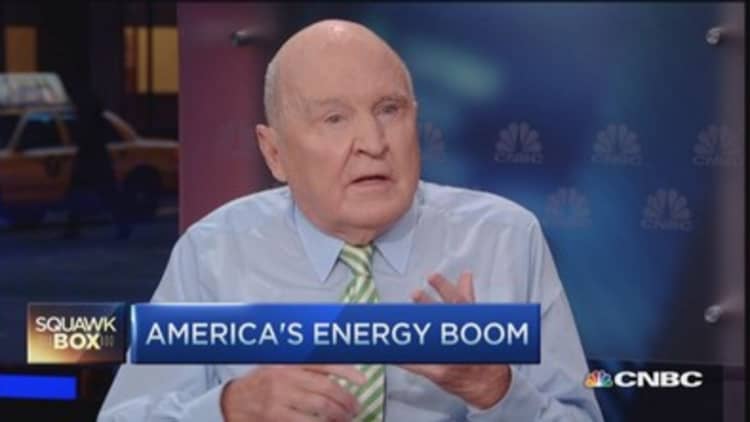

But the strong dollar and the collapse in oil prices have changed that, management guru and former General Electric chief Jack Welch told CNBC on Wednesday.

"You won't see a lot CEOs saying, 'I'm 75 percent global,'" he said in a "Squawk Box" interview. "We don't want to be global at least for the next six months. You want to be a U.S.-centric producer."

"You don't want to be exporting," he continued, because U.S. companies selling goods and services in local currencies overseas are taking hits when revenues are converted back into dollars.

Read MoreJack Welch: Why Fedwould be 'insane' to hike rates

The dollar index—measuring the greenback's strength against a trade-weighted basket of six major currencies—has increased 15 percent in the past six months.

Many U.S. multinational companies have reported a hit on earnings in the latest quarter because of currency fluctuations. Merck became the latest on Wednesday—saying it sees a 27 cent per share negative impact from foreign exchange this year.

Read MoreMerck earnings top expectations, revenue misses

Citing the double-whammy of currency and oil, Welch said, "I've never seen crosscurrents in my 50 years or so in business like they are today."

Peripheral hits based on lower oil prices are "unbelievable," he said, explaining companies may not have direct exposure to crude but they may deal indirectly in regions hit hard by the collapse, such as parts of oil-producing Texas and the Bakken region of North Dakota and Montana where the fracking revolution has been taking place.

Welch said he does not have a prediction for oil prices beyond the "conventional wisdom" of $60 to $70 a barrel by the end of the year. U.S. crude prices—which have fallen more than 45 percent in the past six months—were lower in early trading Wednesday. Oil had been on a four-session, 19 percent winning streak.

Read MoreOil pro: This is 'dead cat bounce'

But Welch does think there are opportunities in the oil patch for investors searching for distressed debt. "There are some assets to buy out there. And some sharp guys will pick up some good assets."