Until recently, the workers who maintain pump jacks for energy firm EEC recorded oil production at the company's 40 wells by scribbling figures into notebooks, transferring the data to paper forms and mailing the documents to the head office in Norman, Oklahoma. There, accountants keyed the data into spreadsheets.

These days, the company's seven pumpers enter the information into an iPad and instantly beam it to computers and tablets in Norman using a program called GreaseBook, named for the notepads the app replaced.

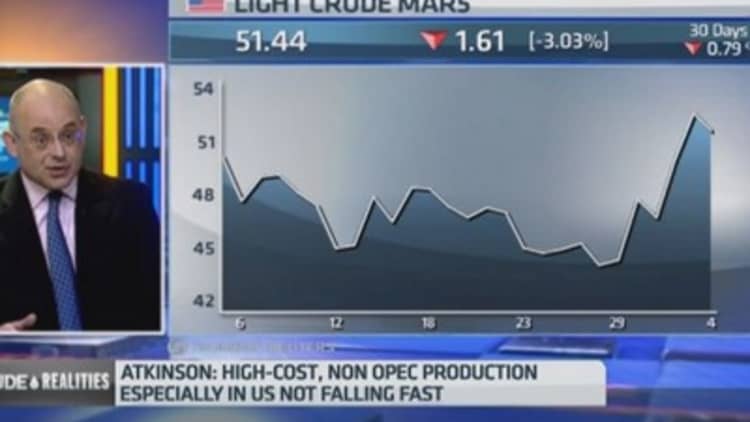

The energy patch is slow to change, but with U.S. crude prices down 50 percent, oil firms are increasingly focused on productivity. That presents an opportunity for tech companies that aim to strip inefficiencies out of drilling, fracking and oilfield services.

Read More 5 ways to play oil under pressure

While the pumpers are now happy to tap and swipe, the transition initially took some convincing, said EEC's owner and president, Jess Porter.

"I have several that are a little bit older and they just sort of looked at me and said, 'What's an iPad?'" he said.

Things have changed from a year ago, when oil was near $100 a barrel and the firms had a tough time convincing energy companies to invest in their cost-saving products.

To be sure, the silver lining to the oil rout will not shine on everyone equally. The companies that will benefit immediately are those whose technology provides quick and clear savings, said Kirk Coburn, founder of Houston-based energy sector investor Surge Ventures.

"When you have really high oil prices, you can make a lot of mistakes and you have margin to play with," he said. "When oil prices are low, the technology-buying decision changes from being a long-term decision to a short-term decision."

Coburn said one company positioned to provide immediate gain is Guard 1 Services, an oilfield security firm that has developed software to track the comings and goings of service providers at well sites in real time. Surge has invested money in Guard 1.

Many of Guard 1's competitors still log traffic on paper, which can make it difficult to track and resolve discrepancies with contractors. By logging arrivals and departures digitally, Guard 1 has created a powerful auditing tool that has millions of data points gathered during the regular course of business.

In one instance, the company flagged $40,000 of overbilling on the part of a company supplying water for hydrofracking, the process of pumping liquid and chemicals into a well to free hydrocarbons from rock formations.

Read More$30 oil could lead to more layoffs: CEO

The mistakes are not always malicious, Guard 1 President Posie Clinton told CNBC. He noted that it can take 1,000 truckloads of water to frack a well, and some exploration and production companies are drilling hundreds of wells.

"It's like balancing a checkbook when you're carrying over a lot of numbers and doing it all on paper. It's easy to make mistakes," he said.

The extra layer of service has given Guard 1 an advantage at a time when its clients are cutting budgets and seeking 15 to 20 percent discounts in order to weather low oil prices. Clinton said he recently edged out two rivals for a big job after presenting the company's data-gathering capabilities to the client's chief financial officer.

The value proposition is also helping GreaseBook, which has seen revenue rise 20 percent in the last six weeks as it signs new clients, founder Greg Archbald told CNBC.

By automating much of the labor involved in recording oil deliveries, employers can put staff to work in more productive parts of the business, which in turn reduces the pressure to lay off workers, he said.

Read MoreOil layoffs could come back to haunt the industry

The technology also gives clients immediate feedback on deliveries from their pump jacks, so they can better forecast cash flow.

"It's sort of like the stock market. You have a portfolio of oil and gas properties, and the idea is to oversee them on a day-to-day basis and to keep costs down," he said.

Despite the current pressure on bottom lines, exploration and production companies will continue to view some potentially cost-saving technology as a long-term investment because it will take more time to integrate into day-to-day operations, according to Surge Venture's Coburn.

That includes the systems made by Deep Imaging Technologies, which is trying to change the way drillers frack wells.

Read MoreThe looming threat to American oil output

The company aims to replace the prevailing technique for determining the success of hydrofracking with one based on electromagnetic measurement that gives engineers real-time data during the frack and could improve the well's output.

Deep Imaging CEO Trevor Pugh acknowledged that potential clients frequently inquire about his company's long-term prospects, but he sees opportunity now that drillers are focused on efficiency rather than merely squeezing more volume out of wells.

"If you're in a position where people are losing their jobs and money is not coming in like it used to, people are more receptive," he said. "When you're just blowing and going where the only purpose is to drill more holes, the story is different."

Whether the industry enters a protracted period of low commodity prices, it is ultimately moving toward greater integration with mobile technology and automation, Coburn said.

Read More Texas may dodge worst of the oil bust

For one, oil producers are increasingly plumbing assets with higher production costs, such as U.S. shale, which builds a case for smarter drilling, he said. At the same time, millennial-aged workers are exercising more influence within the industry as baby boomers age out. These younger oil workers are not just tech-savvy, they are tech dependent, Coburn said.

"They need the technology because the way the old systems are being used today are so antiquated, they don't know how to use them," he said. "Now you have the Millennials saying, 'Look, I want an app for that.'"