HSBC's profits fell to a worse-than-expected $18.7 billion in 2014, hit by difficult Asian trading and geopolitical tensions, sending shares over 4 percent lower.

Analysts had forecast a median of $21 billion annual profit, down 7 percent from 2013.

HSBC addressed the allegations about tax evasion at its Swiss operations, saying: "We deeply regret and apologize for conduct and compliance failures." The bank has come under fire this month after leaked details of how its Swiss subsidiary helped wealthy clients avoid taxes hit the headlines.

HSBC chief executive Stuart Gulliver has had his own tax position dragged into the spotlight after the bank admitted he had a (totally legal) Swiss bank account, to hold his bonus payments from 1998-2003, for privacy reasons.

Gulliver, faces a grilling by U.K. MPs on Wednesday, told reporters Monday: " I have never paid less than the marginal UK tax rate."

Gulliver's pay packet fell to £7.6 million last year, from £8.03 million in 2013, as he gained a smaller bonus of £3.4 million.

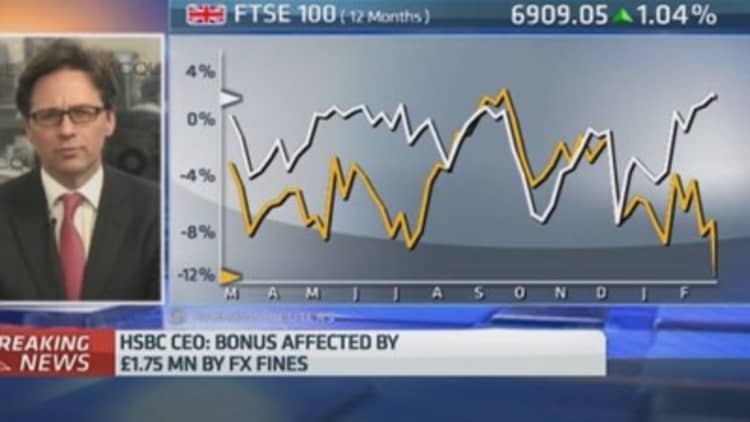

HSBC's shares have fallen since the scandal was first reported. The story is mainly of concern to shareholders if it leads to prosecution or further large fines. While HSBC has already settled with several governments over the allegations, there are concerns that it could still face prosecution in the U.S. if there is sufficient evidence.

HSBC booked a further $809 million of fines for currency market manipulation by its traders and $340 million for redress of U.K. customers mis-sold financial products.

The bank also cut its target for return on equity (RoE), a key measure of investment success, to "more than 10 percent", down from more than 12 percent, after it hit 7.3 percent in 2014. Its dividend of 20 cents per share is also lower than analysts forecast.

"HSBC is being severely penalized by central bank policy. However it's a trend that is unlikely to reverse soon given the slide in commodity prices and the ripple effect on inflation downwards," Chirantan Barua, senior analyst at Bernstein, who has a "buy" rating on the bank's shares, wrote in a research note.

- By CNBC's Catherine Boyle.