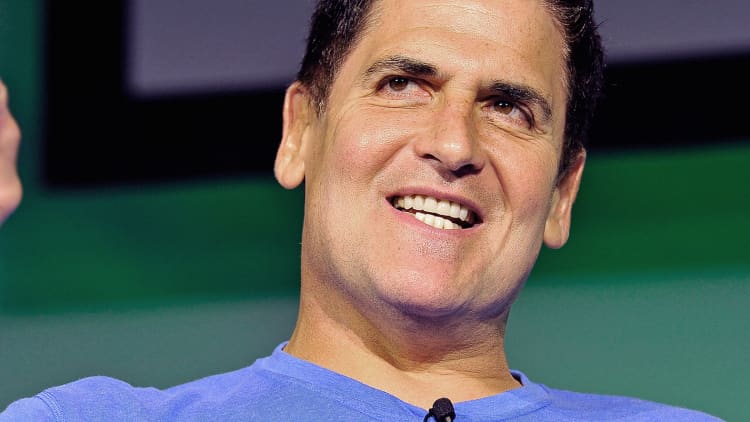

Private investors in apps and other ventures that fail are getting "crushed," billionaire investor Mark Cuban said on Thursday.

"Small individual investors are putting their money into apps with no chance of getting their money back," the Dallas Mavericks owner and "Shark Tank" investor told CNBC's "Closing Bell."

Cuban sees a private technology bubble more dangerous than the public bubble that burst 15 years ago. He contends that angel investors and contributors to apps make more perilous plays than stock traders because their bets lack liquidity.

Read MoreCuban: Tech bubble worse now than 15 years ago

His commentary comes just days after the Nasdaq hit 5,000 for the first time since the tech bubble of 2000. He stressed that he doesn't currently see a bubble in public companies.

"I don't believe there is at all," he said.

Private angel capital is "a drop in the bucket" for the U.S. economy, angel investor Steve Brotman told "Closing Bell." He sees a bubble as something that poses a fundamental risk to wider economic health.

"I'm glad [Cuban is] pointing out the dangers of angel investing. But to call it a bubble, you're yelling 'Fire!' in a crowded theater," Brotman said.

Torrents of private funding lack the liquidity that a stock investment holds, Cuban wrote in a blog post on Wednesday.

"Back then the companies the general public was investing in were public companies. They may have been horrible companies, but being public meant that investors had liquidity to sell their stocks," he wrote.

He added on Thursday that today's apps are the equivalent of websites during the dot-com boom.

"Back then, it was a website. Now, it's an app," Cuban said on "Closing Bell."

Read MoreCuban on net neutrality

Fundamentally, investors need to assess the return they'll get on their investment, Cuban said. Without the ability to sell their stake, today's private investors are left with few options when a project sputters, he said.

He noted that today's tech companies often have to wait longer to go public than they did in the past, which complicates their funding process.