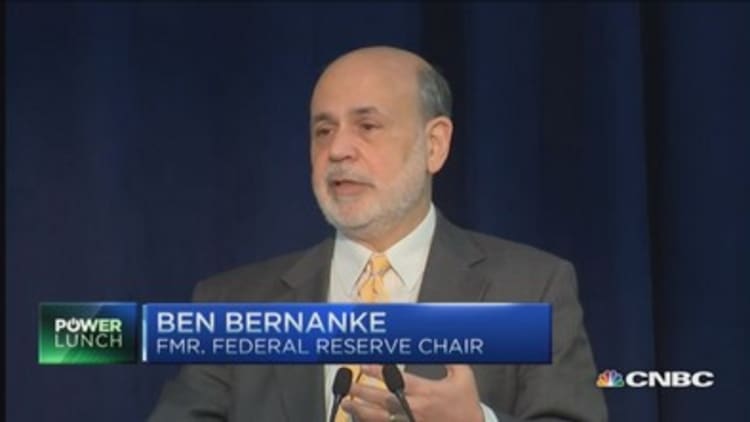

Former Fed Chairman Ben Bernanke, in rare public comments on the economy, said Monday he thinks low interest rates may not be here forever.

Read MoreCramer: This was a 'dud quarter,' and here's why

Bernanke said in a Washington, D.C., speech that downward pressure on rates would ease as economic recovery in Europe and better growth in emerging markets take hold.

"The implications are from that perspective that the downward pressure on global interest rates will probably moderate somewhat, continue to moderate somewhat over time and the pressures for the trade deficit of the United States will probably moderate somewhat over time," Bernanke said.

As for now, Bernanke said Europe "is in a depression basically."

Bernanke also explained the Fed's recent decision to lower its estimate of the long-run unemployment rate to 5.1 percent, saying it likely resulted from the recent decline in the jobless rate along with a lack of wage pressure. The Fed, Bernanke said, is "obviously paying attention to things like real wages to see if those are responding in seeing if we are reaching full employment." But he added that full employment is a difficult number to gauge. "Nobody really has that number with any precision, and the Fed will continue to grope to find out what the right number is,'' he said.

Read MoreUS economy stalled in first quarter: Economists

The former Fed chairman has made only a few public remarks on the economy since leaving office last year. He has instead garnered large fees speaking to private audiences, including many investment banks. Typically, Bernanke has insisted that attendees treat his comments as off the record.

But that may be changing at least somewhat. His speech Monday allowed media coverage. In addition, Bernanke launched a blog Monday on the Brookings Institution website. In an accompanying piece to the blog, Bernanke said, "I left the chairmanship of the Fed in the capable hands of Janet Yellen. Now that I'm a civilian again, I can once more comment on economic and financial issues without my words being put under the microscope by Fed watchers."

In the blog, Bernanke tried to explain why long-term interest rates are low, and said it was part of a long-term trend, not an aberration. He added that recent low real interest rates, that is, adjusted for inflation, are not primarily the result of Fed policy. "Except in the short run, real interest rates are determined by a wide range of economic factors, including prospects for economic growth—not by the Fed," Bernanke said.

He complained about "confused criticism" when he was at the Fed among those who blamed the central bank for hurting savers by keeping rates low. Bernanke argued that it would have hurt savers and seniors more to raise interest rates prematurely since "all indications are that the equilibrium real interest rate has been exceptionally low, probably negative."

Read More