Editor's note: Technical analyst Chris Kimble presents three charts that he believes were the most important and interesting in markets, stocks and ETFs last week.

Russell 2000 Index

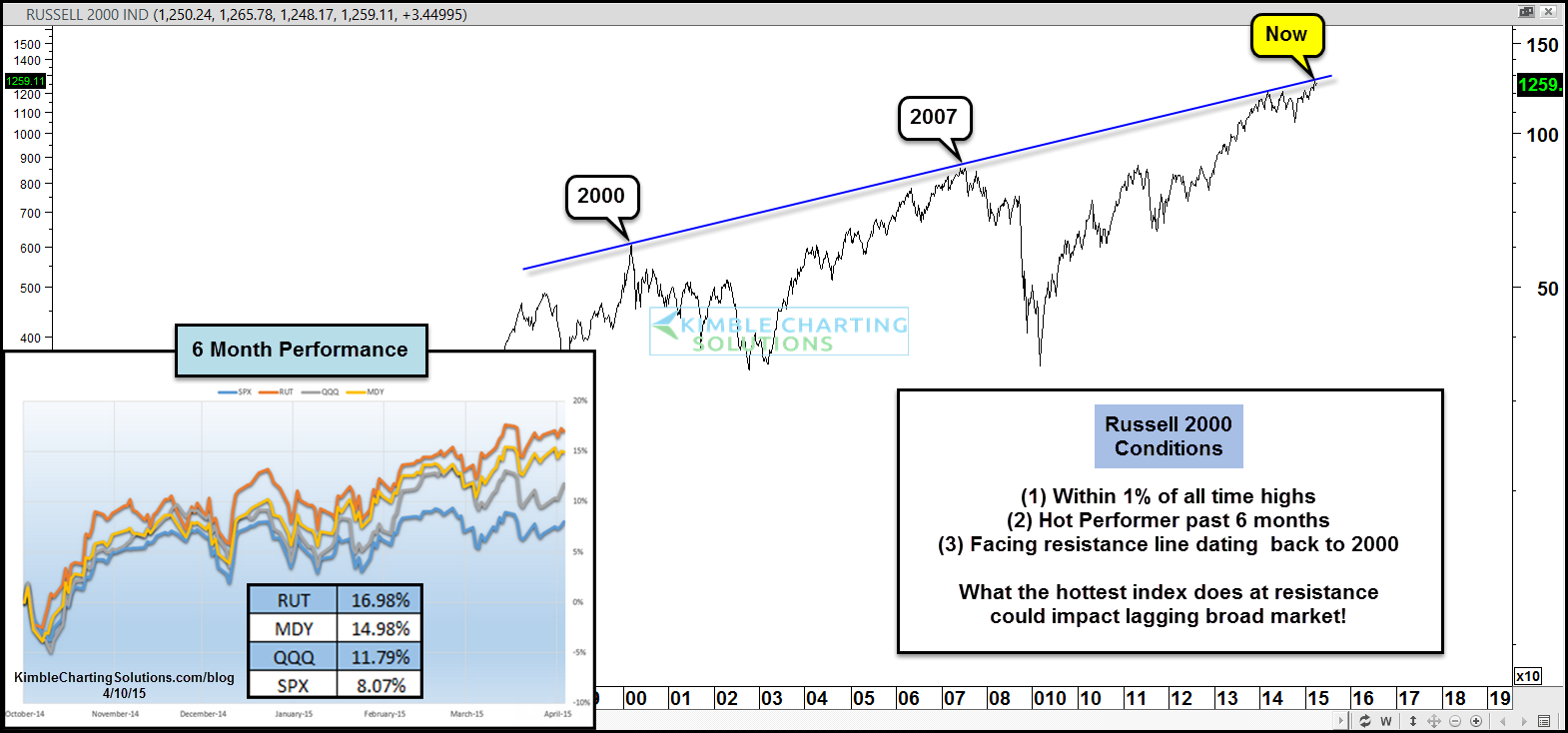

Over the past 6 months, small caps have taken on a leadership role, as the Russell 2000 has doubled the performance of the S&P 500. Small caps are also outperforming technology stocks and mid-caps.

The rally of late has taken the Russell 2000 up against a resistance line that is drawn from the 2000 and 2007 highs. What 'leadership' (Russell 2000) does at this long-term resistance line could have a large impact on the lagging broad markets.

Actionable plan:

Go long the Russell 2000 Index. (The most popular small-cap exchange-traded fund is the iShares Russell 2000 ETF.)