Jim Cramer suspects that those who sold stocks in April were just doing it to get ahead of those who will sell in May. But could they have seller's remorse now that the averages closed in the green on Friday?

"Now, I don't think we're necessarily out of the selling woods, though, because we're in a real conundrum here," the "Mad Money" host added.

Investors are perplexed right now, thanks to the weakening dollar and rising price of crude. They had previously favored stocks of companies within the United States because they weren't hurt by a strong dollar. They also banked on companies that benefited from the low price of gasoline.

But then, when the dollar strengthened, these stocks lost their luster, and now investors are wary of the same stocks they loved just last month. And while they are no longer in love with domestic stocks, the international companies aren't doing so well right now.

Put all of this together, and we have a treacherous marketplace. One where Cramer sees a major sea change happening. One where no stocks are in favor right now: domestic, international, everything! That's what caused a major selloff.

On Friday, investors were finally able to breathe because oil went down and the dollar went up. That stopped the selling, at least for one session. But could investors from April have seller's remorse in May?

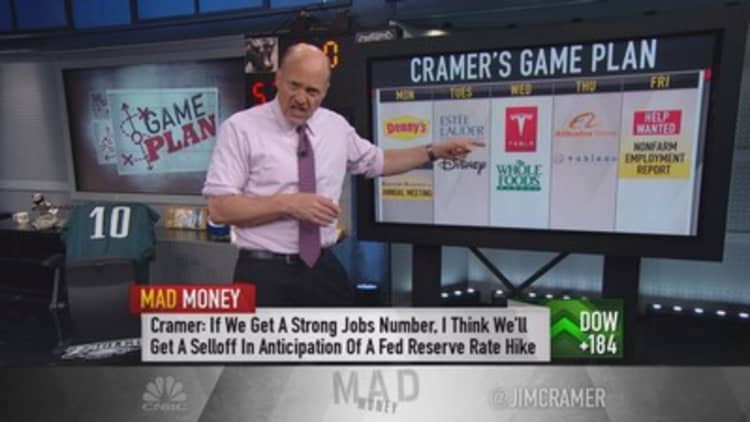

With this in mind, Cramer shared his game plan of stocks and events that he will be watching for next week.

Monday: Berkshire Hathaway annual meeting, Denny's

Berkshire: Monday morning brings the market's reaction to the Berkshire Hathaway annual meeting from the weekend. Lately, Cramer has seen the same old pattern. Investors get gloomy and sell, and then they hear the Oracle of Omaha speak, and it brings their spirits back up.

Cramer expects Monday to be no different. In fact, he thinks Warren Buffett will be filled with optimism when he speaks.

"So expect Buffett to work some magic when we come in Monday," he said.

Denny's: With the price of oil on the rise, investors have turned against the biggest beneficiaries, the retail and restaurant groups. Will this craziness ever end? Cramer thinks Denny's will have some great things to say, and the stock will go higher on Tuesday.

Tuesday: Estee Lauder, Disney

Estee Lauder: Cramer is looking for a big number from it, but doesn't expect a pop in the stock when it reports.

Disney: Cramer is worried that this has run too much ahead of the quarter. Thus he recommended investors just hope that both Disney and Estee Lauder come down on Monday so they can buy it on weakness. Otherwise you have to wait.

Wednesday: Battleground day—Tesla, Whole Foods

Tesla: Frankly, Cramer's not expecting much from Tesla. He absolutely hated its last quarter and thinks the stock has run lately because it has had a high-profile announcement. He expects the stock to run up ahead of the quarter, and then sell off.

Whole Foods: The stock has acted terribly lately, which tends to foreshadow weak numbers. However, Cramer thinks this one has been punished quite a bit. He recommended buying half ahead of the quarter and then half later if the stock sells off.

Thursday: Alibaba, Tableau Data

Alibaba: Forget it—Cramer does not want to own it. If you want to own it, he advised you to buy Yahoo, which has a huge stake in the company.

Tableau Data: This is the single most expensive stock that Cramer follows, because it has such great growth. If Tableau goes up after it reports, Cramer thinks it is a good idea to get in on stocks like Workday and Splunk, which could have pin action associated with Tableau.

----------------------------------------------------------

Read more from Mad Money with Jim Cramer

Cramer Remix: Take this action on Apple now

Cramer: Buy oil stocks? Forget it

Cramer: Stocks are cursed—Apple's fault

----------------------------------------------------------

Friday: Nonfarm employment report

The Labor Department's nonfarm employment report is the single most important macro number that anyone could imagine. Investors are saying that if we have strong job numbers, the Fed will likely tighten soon.

"But I think we're in a real rock-hard-place situation here, because if employment is robust, then we'll sell off in anticipation of a Fed rate hike," Cramer said.

What if the number is weak? That will mean there is a sell off ahead, out of fear that the economy is slowing. It's a lose-lose situation.

Ultimately, Cramer suspects that investors who sold in April will have seller's remorse in May. That will only get worse when Warren Buffett works his magic on Monday and tells everyone to buy. But after that, it will go right back to business as usual, and Cramer will be taking his cue from stocks that move after earnings.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com