European government bond yields, which have been on a steady downward trend for years, are suddenly trading at their highest levels in more than two months – and analysts expect this move higher to continue.

The yield on Germany's 10-year Bund, the benchmark in Europe, was trading at 0.43 percent on Monday. It has soared from a record low of 0.05 percent just last month, as investors reassess bullish bets on government bonds in Europe and the U.S., where debt yields have also risen sharply.

Yields rise when the price of a bond falls, reflecting a greater risk attached to holding that bond.

"We are in a correction in government bond markets, but we're still looking for higher yields in the next few weeks," Christoph Rieger, head of rate and credit research at Commerzbank, told CNBC.

Read MoreUS bonds post steepest weekly sell-off in two months

"There are technical reasons for this, but also fundamental reasons, such as more supply coming into the market in May and June, tentative signs of a recovery in Europe and a U.S. Federal Reserve that is looking to normalize rates this year."

Data last week showed that the euro zone emerged from four months of deflation in April, while the European Commission on Tuesday revised up its 2015 growth forecast for the euro area to 1.5 percent from a previous estimate of 1.3 percent, reflecting stronger economic data.

Ten-year Bund yields more than doubled last week, to about 0.37 percent from around 0.154 percent; the 22 basis point rise was the largest one-week back up in yields since June 2013. Bund yields are also back above levels seen just before the European Central Bank (ECB) started buying bonds in early March.

Bond surprise

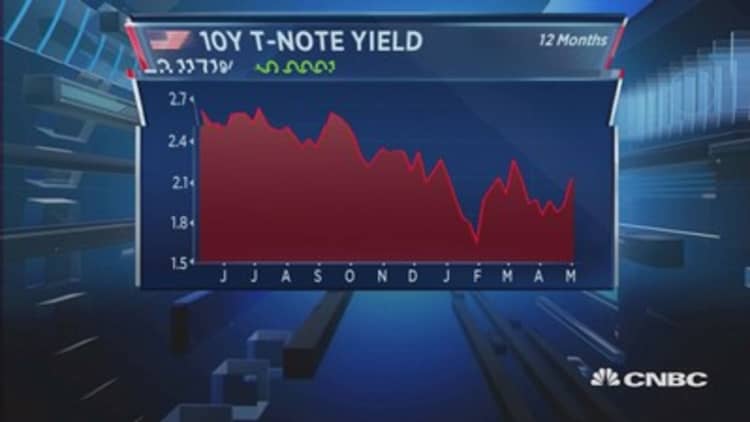

Kit Juckes, macro strategist at Societe Generale, said the move in Bund yields had dwarfed that in U.S. Treasury yields, which have risen by about 14 basis points over the past week. The U.S. Treasury market often sets the tone for trade in other sovereign bond markets.

"For how long can Bund yields rise faster than Treasuries?," Juckes asked in a note on Tuesday.

Read MoreHere's the real key to the bond market

"European inflation bottoming-out and the change in the Greek negotiating team at debt talks may have been catalysts for the sell-off, but the real driver was that yields fell too far, too fast and position-squaring in thin markets has magnified what looks far more like a correction than a major trend change."

Indeed, helped by the anticipation of quantitative easing from the ECB, the yield on the 10-year German Bund fell about 50 basis points between the end of last year and mid-April, when it hit a record low.

Strategists added that although the ECB's asset-purchase program would continue to put downward pressure on bond yields over the long-term, the volatility in debt markets should not be underestimated.

"Certainly from a European perspective, what they (policy makers) don't want is extreme volatility in European fixed income markets," Derek Halpenny, European head of global markets research at Bank of Tokyo-Mitsubishi, said Tuesday, talking on CNBC about the spike in debt yields.

"I think the ECB would be standing back and not being too concerned at this time," he added.

Follow us on Twitter: @CNBCWorld