In an environment where the Greek situation is finally resolved and a nuclear deal with Iran is progressing, Jim Cramer thinks it could pay to take a look at some of the most loved stocks from every possible lens.

That is why "Mad Money" is rolling out Chart Week. So, for those who love Shark Week on the Discovery Channel, this could be a lot more lucrative.

To get the inside scoop on the stock that is most owned by Cramericans, Cramer spoke with Ed Ponsi, a technician and managing director of Barchetta Capital Management and colleague of Cramer's at RealMoney.com, to discuss the future of Apple.

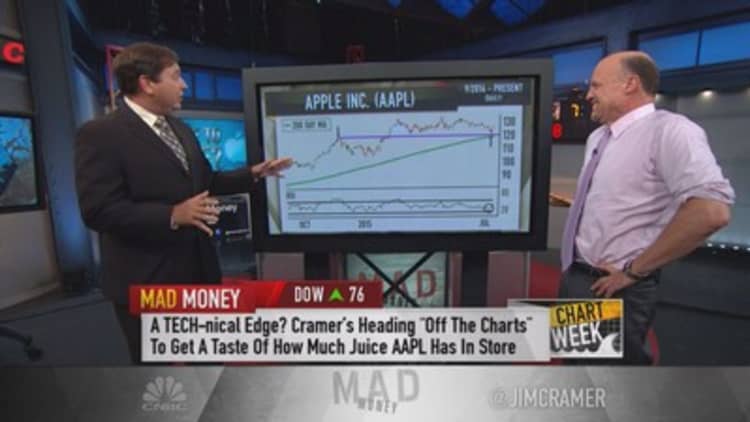

When looking at the charts, what Ponsi loved most was that resistance becomes support and support becomes resistance.

"You can see a perfect example of that on this chart," Ponsi said.

Apple reversed so quickly and punished the short-sellers so quickly and so severely, I don't think they are going to be back for a little whileEd Ponsi

He saw that the level of $120 was a ceiling of resistance late last year, and now it has become the floor of support for the stock at the levels where it is currently trading. And while Apple has had some delicious gains this year, many investors were scared when the stock dropped to $120 on July 9.

The best part about the chart in Ponsi's interpretation was that the relative strength index gave a buy signal for the first time in about two years.

Going forward, Ponsi said that the charts need to take out the 200-moving day average, which is still intact.

"Apple reversed so quickly and punished the short-sellers so quickly and so severely, I don't think they are going to be back for a little while. It's basically like putting your hand on a hot stove," Ponsi added.

Ponsi's long-term projections show that there is a clear resistance level in the low $130s, which is not far away from its current price. However, the charts do indicate that Apple is still on a healthy uptrend.

Ultimately, Ponsi said that Apple is a good stock to own, despite any activity that occurred in the past few weeks. So, while many investors tell Cramer that they are disappointed with Apple because it doesn't have enough activity, Ponsi disagrees.

----------------------------------------------------------

Read more from Mad Money with Jim Cramer

Cramer Remix: Buy these four stocks!

Cramer: Charts predict Facebook headed much higher

Cramer's checklist to end the Greece nightmare

----------------------------------------------------------

"Doing nothing is great sometimes, Jim, because this is a consolidation. While Apple is doing nothing, what's happening? The earnings are going up, the cash position is going up, the price earnings ratio is going down—all the things that the fundamental people want to look at are improving, so this is actually very good," Ponsi said.

Cramer asked Ponsi if Apple could run up so much that it takes out the all-time high. Ponsi said he didn't even consider this to be a question, because the stock is not far away from that level, currently. So, while it is all dependent on the overall market, Ponsi could easily see the stock hitting $140 without much difficulty.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com