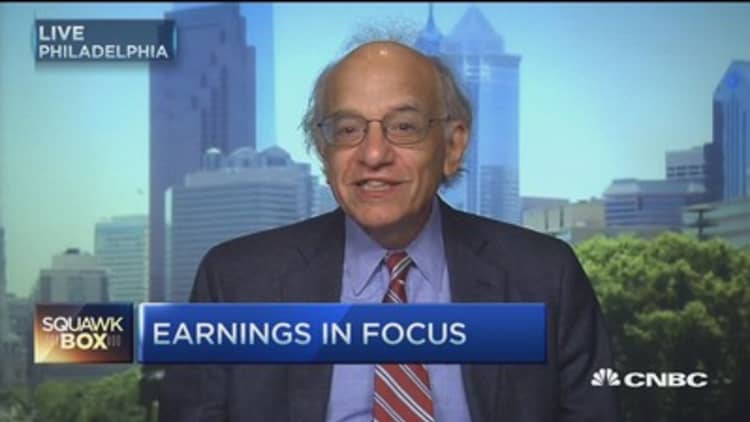

Despite international turmoil and weaker-than-expected June retail sales, longtime market bull Jeremy Siegel said Tuesday he still believes the Federal Reserve will raise interest rates in September, giving U.S. stocks a runway for further gains.

"Once we get the first increase of the Fed's rate out of the way … we're going to have a very good fourth quarter," the Wharton School finance professor told CNBC's "Squawk Box."

Read More Faber: This is biggest threat to our global economy

"The world is not going to end," he added—referring to the Greek bailout deal moving forward and the meltdown in China's stock market stabilizing.

But Siegel acknowledged the stronger dollar and lower oil prices—which he views as long-term positives for the U.S. economy—are short-term negatives for multinational companies.

The dollar, for example, is estimated to have "cut perhaps $8 off S&P earnings, which are only going to be up $2 [this year]," he said. "Good news is those two factors have stabilized."

Read More Cramer Remix: Buy these 4 stocks!

"Earnings look pretty good in 2016," he continued. "I still think 20,000 is possible for the Dow" by the end of the year.

Siegel's prediction of September liftoff for the Fed puts him in the minority among market watchers.

In fact, the CME FedWatch tool—which tracks daily market reaction on potential changes to the fed funds target rate—pegs a September hike at just 13 percent, with December at 48 percent and January 2016 at 63 percent.

Read More Where stocks are up 300% and no one's cheering

The Fed's first rate hike since 2006 might slide, he admitted, but stressed it's the trajectory that's most important. "We're not going back to 4 percent [on fed funds], which the Fed has often called its neutral rate. The world is different. Inflation is lower. Growth is lower."

That rate backdrop should keep supporting stocks, Siegel concluded.