There was blood, sweat and tears on the streets of Athens last night, as violent clashes broke out and the Greek parliament voted on wide-reaching reforms that are a condition of a third bailout from lenders.

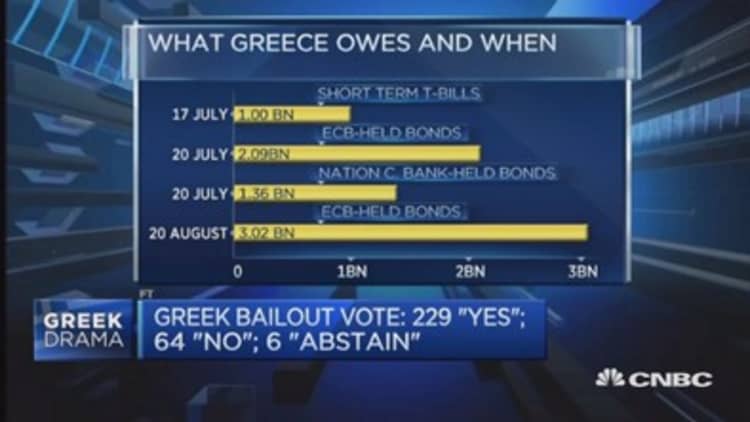

In the early hours of Thursday morning, the austerity bill that will pave the way for financial aid worth 86 billion euros ($94 billion) was approved with 229 votes in the 300-seat chamber. There were 64 votes against it and six abstentions.

As voting got underway, however, there were rebellions both within parliament and outside it. Some of Greek Prime Minister Alexis Tsipras' own party voted against the measures, and up to 10,000 anti-austerity protestors demonstrated across the Greek capital. Some of the protests became violent and police used tear gas to try to disperse groups throwing petrol bombs.

Read MoreGreek Parliament votes in favor of bailout plan

Against a backdrop of both agreement and rebellion over yet another stringent bailout, what happens next? CNBC explains.

Cabinet reshuffle

Although the controversial proposals were approved with support from within the Greek government and from pro-European opposition parties, Tsipras lost the support of a quarter of Syriza party members of parliament.

Some 39 hardliners within Tsipras' own party voted against the bailout package, which requires vast spending cuts, pension reforms and tax rises, including former finance minister Yanis Varoufakis, the energy minister and deputy labor minister. Deputy Finance Minister Nadia Valavani resigned ahead of the vote.

A cabinet reshuffle is now widely expected, and some analysts warned new elections could be on the horizon.

"PM Tsipras will try a cabinet reshuffle, but if that fails to sure up confidence in Syriza, a worst case scenario would be snap elections," Jasper Lawler, market analyst at CMC Markets said in a note Thursday morning.

Former Greek finance minister Gikas Hardouvelis agreed.

"He (Tsipras) passed the legislation (but) he lost a quarter of his MPs who said 'no'... The minimum (thing to expect now) would be the reshuffling of the government," he told CNBC Europe's "Squawk Box" Thursday.

"It's very important for Mr Tsipras -- if he wants to stay in power – to ensure that his ministers do believe in the reforms and work hard and push. He cannot afford to have people in the ministries that are against what has been decided now."

Despite Tsipras saying ahead of the vote that he did not believe in the deal, Hardouvelis said the prime minister could implement the reforms if he believed they were progressive.

"Opening up professions, fighting oligopolies, fixing the public sector, justice sector and tax system -- all these things give power to the people," he said. "If he is a part of that and he does do reforms, he will succeed. But if he does not…he will be gone from the political scene. It's up to him at this point."

Snap elections in Greece could happen in September or October, Hardouvelis added.

Bridge Financing

On Thursday morning, euro zone finance ministers are due to hold a conference call to discuss the vote, ahead of the European Central Bank's (ECB) latest interest rate decision at 12:45 p.m. London time.

The focus, however, is likely to be on whether the ECB will extend more emergency liquidity assistance (ELA) to Greek banks that have remained shut for over two weeks with capital controls on withdrawals. Aside from its banking system, Greece also needs financial aid to make a debt repayment to the ECB on July 20.

The approval of the bailout terms by the Greek parliament is expected to pave the way for Greece to access European Union funds via the European Financial Stabilization Mechanism (EFSM) - a short-term financing solution. This has, however, caused consternation among non-euro-zone countries like the U.K., which fears its taxpayers will end up funding part of Greece's bailout.

Debt writedown

But although its short-term financing needs look likely to be met, the question of Greece's debt still looms large.

Greece has already received two bailouts worth 240 billion euros and is struggling to make the repayments to its lenders, having missed two payments worth a total of 2 billion euros to the International Monetary Fund (IMF).

Indeed, the IMF caused a stir ahead of the vote calling for Greek debt writedown, although Germany (the largest euro zone lender to Greece) has so-far opposed debt forgiveness, arguing that it could set precedence for other indebted members of the single currency bloc.

Read MoreWhat's behind the IMF attack on the Greek deal?

On Thursday, German Finance Minister Wolfgang Schaeuble said that a solution to Greece's problems without a debt haircut would be difficult, Reuters reported.

However, he told Germany's Deutschlandfunk radio that such a move would be incompatible with the country's membership of the euro, meaning that a temporary exit from the single currency "would perhaps be the better way."

- By CNBC's Holly Ellyatt, follow her on Twitter @HollyEllyatt. Follow us on Twitter: @CNBCWorld