Jim Cramer has said many times before that Johnson & Johnson needs to break itself up. And after Johnson failed yet again to deliver an upside surprise last week, his warning comes with a dose of urgency!

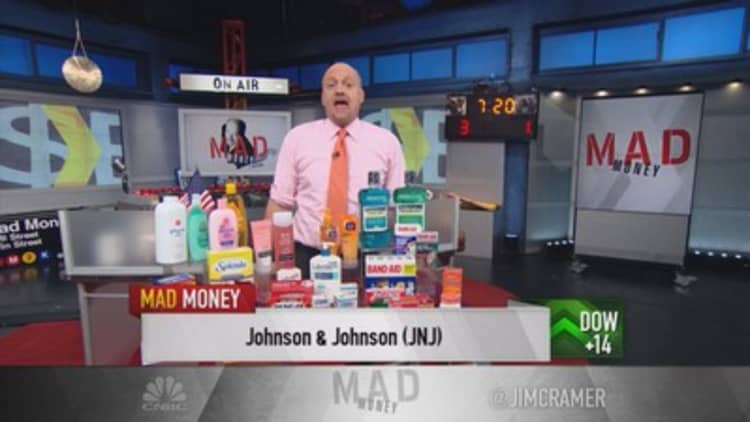

Currently, the company has three different businesses under one roof: pharmaceuticals, consumer health care products and medical devices. Wowzer! Those are three diverse product lines, with virtually no overlap, all under one roof.

"I think these divisions could do better separately than as one combined company that is confusing to manage or even understand," the "Mad Money" host said.

To Cramer, it's a textbook case of the parts being worth more than the whole. First of all, the Johnson's pharmaceuticals division has been a real growth engine.

Yet, the company still needs to stop the bleeding from its medical device business, boost sales in the consumer business area and also sustain the growth of its pharma business.

How the heck can it do all of that?

"I think, as we have seen, that it would be very difficult to manage as a single company," Cramer said.

However, it could stand a chance to accomplish these goals if it finally decided to split up the three segments into separate companies—one for pharma, one for medical devices and one for the consumer.

All three units have very disparate customer bases, manufacturing needs and distribution channels. In Cramer's perspective, to have all of these in one company is completely nuts! Thus, if it broke up into three different companies, it could drill down on each specific customer base and figure out what works.

Cramer saw just how successful the value creation can be by splitting when Abbott Labs broke itself up into a medical device company and a pharma company called AbbVie. Since that spinoff took place in January 2013, Abbott is up 54 percent and AbbVie has more than doubled.

Additionally, the Abbott and AbbVie split allowed AbbVie to make better decisions, which was why it was able to buy Pharmacyclics for $21 billion earlier this year.

This is exactly why Cramer thinks Johnson & Johnson should follow the Abbott Labs playbook, because he believes the consumer and medical device divisions would be better run on their own.

"At this point, I wouldn't be surprised if an activist comes in and pushes for this Abbott Labs-AbbVie style transformation. I don't care how big JNJ is, this one's ripe for the prodding," Cramer added.

----------------------------------------------------------

Read more from Mad Money with Jim Cramer

Cramer Remix: My call on foreign markets

Forget sectors! The right way to diversify

Speculative stocks: Big rewards with big risks

----------------------------------------------------------

Based on comparisons in the same industries, Cramer thinks Johnson & Johnson's consumer business could be worth $10 a share; the medical device business could be worth $63 a share; and the pharma business could be worth as much as $78 a share. When added up, that's a sum of parts valuation of $151. Considering that it closed at $100 on Monday, that's quite a boost!

Ultimately, if Johnson & Johnson really wants to shine, Cramer thinks it needs to break up. There is a beautiful jewel of a pharmaceutical company buried in there, and it will give the company a chance to turn itself around and for Wall Street to understand it better.

"I think the value creation from a three-way corporate divorce could be enormous, roughly 50 percent from where JNJ's currently trading," Cramer said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com