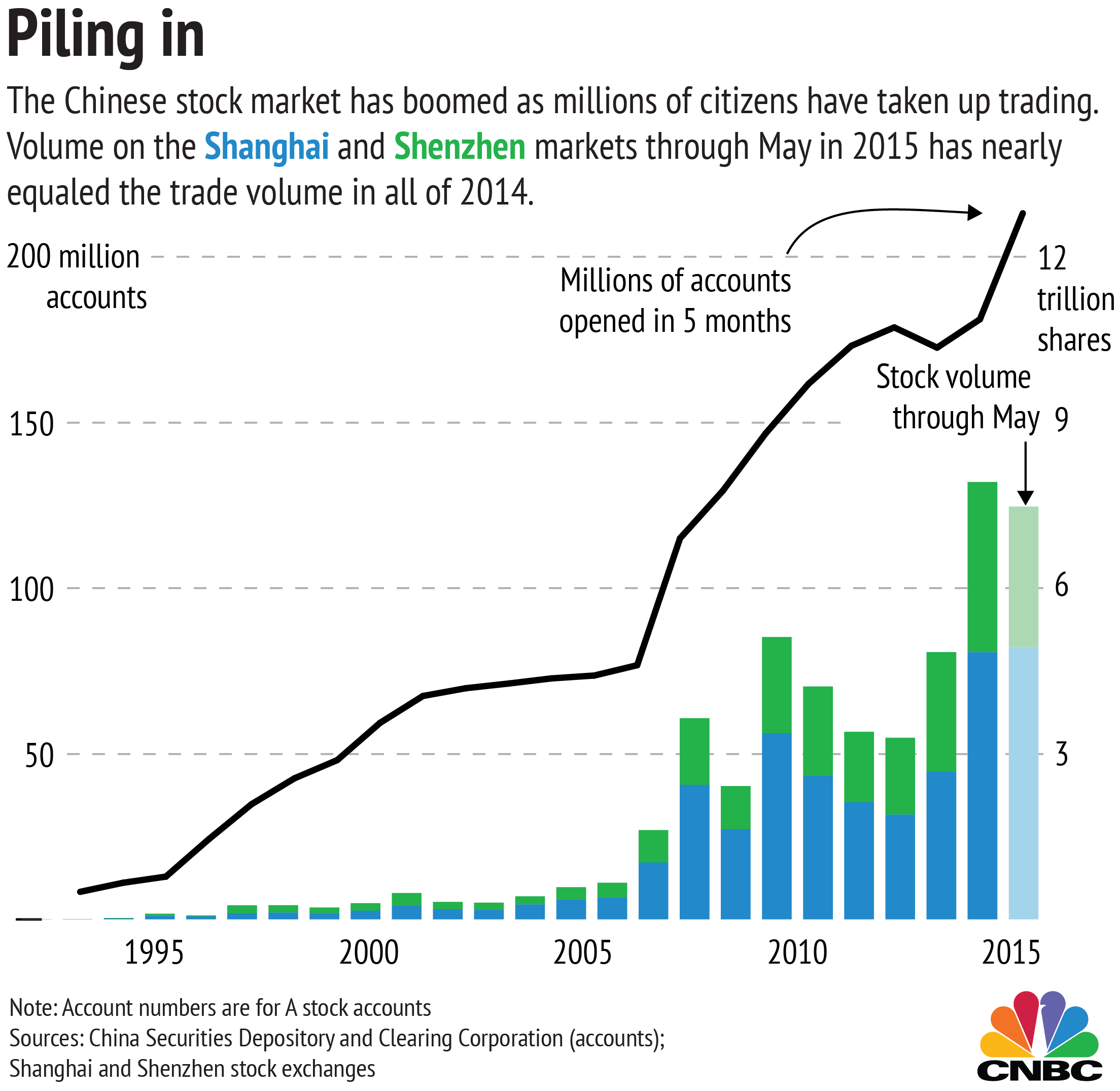

China's stock market took another turn for the worse this week, with stocks in the Shanghai composite falling more than 8 percent on Monday and another 1.7 percent on Tuesday. Shares in the smaller Shenzhen exchange were down 2.3 percent Tuesday.

The carnage was distributed across the market — looking at both exchanges, only one of the 111 industries tracked by FactSet pulled through on Monday with a positive return (restaurant stocks grew 1 percent). Eleven industries, including telecommunications, railroads and Internet retail companies, fell by 10 percent or more.

Here's three things you need to know to understand the Chinese markets—and how this slip is different than what's come before.