U.S. stocks closed higher on Monday after the release of positive homebuilder data as investors digested weak manufacturing data and falling oil prices while eyeing the release of the Federal Reserve's minutes. (Tweet This)

The National Association of Home Builders index rose 1 point to 61, its highest level since November 2005.

"I think the fact that it was positive really turned the market around," said William Lynch, director of investments at Hinsdale Associates.

The index's data release propelled stocks up and helped the S&P 500 to close above its 50-day moving average for the first time since Aug. 10. The Nasdaq Composite also rose more than 0.7 percent as biotechnology stocks rose about 2 percent and Apple jumped more than 1 percent.

"They both have had a few corrections in the past few months," said Zachary Karabell, head of global strategy at Envestnet. "This is at the other side of that correction."

Before trading higher, stocks opened with the Dow Jones industrial average falling as much as 136 points, while the S&P 500 an the Nasdaq also fell sharply on the heels of weak manufacturing data.

"You can't ignore that the New York manufacturing numbers came in so weak," said Mark Luschini, chief investment strategist at Janney Montgomery Scott.

The New York Fed said that manufacturing activity for the state fell from 3.86 in July to -14.92 in August, its lowest since April 2009.

Read More

Economists polled by Reuters had expected the index to rise to 5.00 this month. A reading above zero indicates expansion.

"Bottom line, this number was terrible and maybe we're about to see the Q3 inventory giveback that was such a lift to Q2," Peter Boockvar, chief market analyst at The Lindsey Group, said in a note. "It was not a good start to the August data and a stronger dollar, weak growth overseas and a still 2% US economy doesn't lend itself to a robust manufacturing outlook."

Nevertheless, "That is a very volatile number month-to month, so you want to take it with a grain of salt," said Scott Brown, chief economist at Raymond James.

The last economic data set due out on Monday is net long-term Treasury International Capital (TIC) flows.

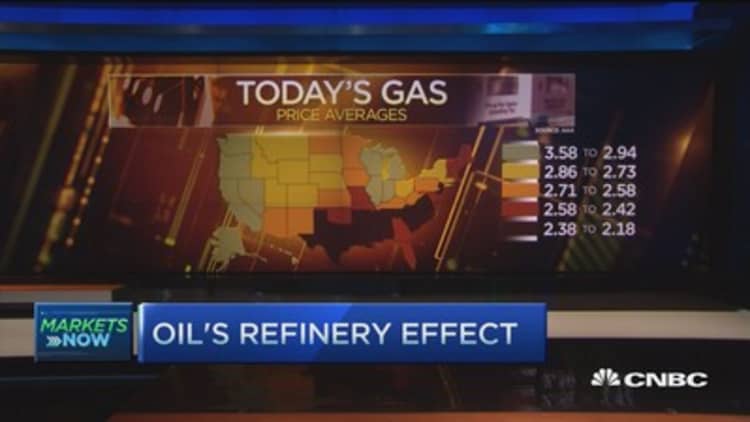

Wall Street also kept an eye on oil prices, which continued to fall on Monday trading.

Read More Apple is building a self-driving car: Report

"Like it or not, we are correlated to oil," said Art Hogan, chief market strategist at Wunderlich Securities. "Until we find some stabilization, oil will continue to weigh on stocks."

U.S. crude prices were around multi-year lows and settled down 63 cents, or 1.48 percent, at $41.87 a barrel, its lowest settlement since March 3, 2009.

"We're at levels where oil is becoming problematic," said Randy Frederick, managing director of trading and derivatives at Charles Schwab, adding that if oil prices hold at these level, companies in the oil market will be forced to cut more jobs.

"There's a sweet spot for oil and we're probably below that," Frederick said.

In other news, The Federal Reserve is scheduled to release the minutes from its July meeting Wednesday at 2 p.m.

Read More Can the Fed justify an imminent rate hike?

"This is a week where the key event is going to be the Fed minutes," said Peter Cardillo, chief market economist at Rockwell Global Capital.

Still, Frederick added that he does not expect any surprises coming from the minutes, while Hogan added that a September move is still on the table. "The data's job is to dissuade [a Fed move] and not persuade the Fed not to move," Hogan said.

Nonetheless, TD Ameritrade Chief Strategist JJ Kinahan said that "people are afraid about whats on those minuted."

Kinahan added that this fear is reflected on the fact that the CBOE Volatility Index and U.S. Treasury's were all up on the day. "There is some underlying trust about [this market]," he said.

The CBOE Volatility Index (VIX), widely considered the best gauge of fear in the market, traded near 13 on Monday, while the yield on the benchmark U.S. 10-year note fell to about 2.14 percent.

Overseas, Asian stocks ended mixed amid continuing China worries and better-than-expected Japan GDP data.

The People's Bank of China set the yuan's midpoint at 6.3918 against the dollar, weaker than the yuan's close of 6.3918 in the previous trading session.

"I think the general concern about China is why they had to weaken the currency against the dollar," said Robert Pavlik, chief market strategist at Boston Private Wealth. "They're not giving us the full picture."

Read MoreUS dollar bull run hits global dividend payouts

Japan's economy shrank at an annualized pace of 1.6 percent in the April-June period, better than a Reuters' estimate of 1.9 percent contraction but well below a revised 4.5 percent expansion in the first three months of 2015.

"I think these factors are going to keep this market in a tight trading range in a sea of uncertainty," Cardillo added.

European equities closed mixed despite earlier gains as investors watched for progress being made in completing Greece's third bailout program.

In corporate news, Amazon CEO Jeff Bezos responded to Saturday's New York Times story about the company's workplace culture, saying the Amazon described in the newspaper's story was not an accurate depiction of it.

Cosmetics maker Estee Lauder posted mixed earnings results, beating on earnings per share but missing on revenue citing "macroeconomic headwinds and challenges."

Read More Why oil may not get the cure it needs: Analyst

Companies reporting after the bell include Urban Outfitters and Agilent.

Walt Disney said it would be adding Star Wars-themed lands to its Disnelyland and Disney World parks during its D23 expo.

Universal Pictures continued its highly successful year as "Straight Outta Compton" led the weekend box office with over $56 million in U.S. ticket sales..

Target also announced that Chief Financial Officer John Mulligan would move to the newly created Chief Operating Officer position.

Major U.S. Indexes

The Dow Jones Industrial Average closed up 67.25 points, or 0.39 percent, at 17,545.10, led higher by UnitedHealth Group and Chevron leading decliners.

The ended 7 points higher, or 0.52 percent, at 2,099, with health care leading nine sectors higher and energy lagging.

The Nasdaq closed up 43.46 points, or 0.86 percent, to 5,091, as biotechnology stocks rose 2.08 percent on the day and as Apple rose 1.03 percent.

Gold futures settled up $5.70 at $1,118.40 an ounce.

The dollar index rose to trade at 96.81.

Advancers led decliners 2 to 1 at the New York Stock Exchange, with an exchange volume of 699.10 million and a composite volume of 2.826.60 billion at the close.

On tap this week:

Monday

Earnings: Urban Outfitters, Agilent

4:00 p.m.: TIC data

Tuesday

Earnings: Wal-Mart, Home Depot, Medtronic, TJX Cos., Hain Celestial, Analog Devices, Dick's Sporting Goods, La-Z-Boy

8:30 a.m.: Housing starts

Wednesday

Earnings: Lowe's, American Eagle Outfitters, Target, Staples, Hormel Foods, L Brands, NetApp, Synopsys

8:30 a.m.: CPI

2:00 p.m.: FOMC minutes

Thursday

Earnings: Gap, Hewlett-Packard, Salesforce.com, Brocade, Mentor Graphics, Royal Ahold, Buckle, Madison Square Garden, Toro, Intuit

8:30 a.m.: Initial claims

10:00 a.m.: Existing home sales

10:00 a.m.: Philadelphia Fed survey

Friday

Earnings: Deere, Foot Locker, Ann

More From CNBC.com:

- Survey: Oil prices seen below breakeven for frackers

- NYT article doesn't describe the Amazon I know: Bezos

- Ron Paul: Fed may not hike because 'everything is vulnerable'

—CNBC's Peter Schacknow and Reuters contributed to this report.

DISCLOSURE: Universal Pictures is owned by Comcast, CNBC's parent company.