The market's dramatic selloff was difficult and uncomfortable but merely "choppy seas" for the long-term investor, the chief investment officer of the nation's second-largest pension fund said Monday.

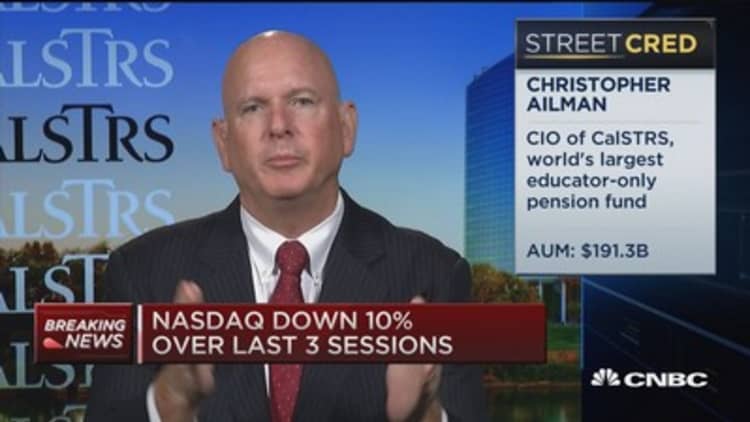

"We're going to ride this out," said Christopher Ailman of the California State Teachers' Retirement System (CalSTRS), with $191.3 billion in assets under management.

Stocks plummeted more than 3.5 percent Monday, with the ending nearly 80 points lower in correction territory. The Dow Jones industrial average closed almost 600 points down.

Ailman pointed out that CalSTRS is focused on the long term, with a 30-year horizon. The fund has 55 percent of its portfolio in global stocks, with a weighting towards the United States.

Read MoreWhat Bill Miller is buying in market selloff

While CalSTRS is riding out the storm, it has been rebalancing, shaving off profits since spring, Ailman told CNBC's "Closing Bell."

"I've been saying for a long time I think the market is long in the tooth and this bull market was getting old. This change in direction is probably going to cause the market to be choppy," he added.

"The market is going to choppy easily for a couple of more weeks but the key is the U.S. economy is still in good shape."

In addition to taking some profits, the fund went long Japan over a year ago and has been slowly "feathering in" trades to Europe. While Ailman is also looking at emerging markets, he's worried about a hard landing in China.

Eventually there will be an opportunity there, he said, but "you have to pick specific countries to get this right."

Read MoreDon't trust your intuition during this market selloff

He also noted that long-term investments such as real estate and private equity, which have lagged the bull market, are going to start to kick in.

"They still have opportunities to grow."