This week, stock markets put investors on a stomach-churning roller-coaster ride. While uncertainty over China's economy has been widely cited as a catalyst behind the whipsaw action, one market strategist says the underlying problems in the U.S. are actually much deeper.

That, he predicts, will make it difficult to climb back to record highs by the end of this year.

"This is not just a China issue," Evercore ISI head of portfolio strategy research Dennis DeBusschere told CNBC's "Fast Money" this week, dismissing theories that China's devaluation of its currency, the yuan, was also the culprit.

Read MoreRubio: China's leaders are tyrants

"This CNY devaluation is not the reason why the market has moved lower," DeBusschere added. "That's like blaming Lehman Brothers for the decline in stocks in 2008."

While DeBusschere conceded that China's surprise currency devaluation was the straw that broke the rally's back, he said there were a number of larger, long-trending domestic indications that signaled the bull run was in fact running out of steam. Among them, he said, is the fact that U.S. investors have been taking less risk onto their portfolios for the past year.

Riskier bets, he said, "have really been under pressure … and then it really accelerated to the downside following the CNY devaluation."

Get ready for lower returns

Source: Evercore ISI

In a research note this week, Capital Economics noted that "there can be little doubt that the valuation of China's stock market had become stretched before it began to slide." The firm added that the price to earnings ratios of companies trading on the were well above historic averages.

For DeBusschere, the abatement of risk was a red flag long before China sparked the most recent selling. "Typically when you see these risk-on factors under perform, the economy tends to be slower, not only in the U.S. but globally, and the forward returns for the market are much lower," he said.

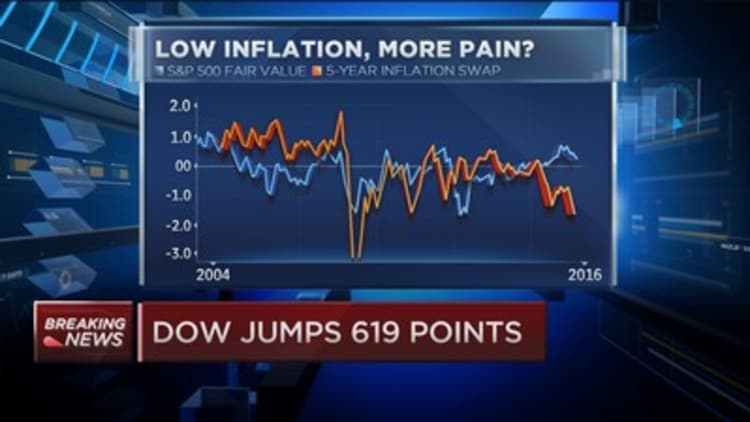

Another factor that may have signaled the selloff and could lead to lower returns going forward is inflation. "If you have very low inflation expectations, it's very difficult to see a multiple expand, and with earnings under pressure, the forward returns on the market will be lower," he said.

Source: Evercore ISI

Although slower growth, de-risking and inflation could continue to pressure markets, DeBusschere said stocks could see a relief rally in the near term.

"Typically speaking, when you have very low returns going into the fourth quarter, you've had better-than-expected returns in the fourth quarter," he said. "So you have some conditions there that would suggest a fourth-quarter rally."

Still, DeBusschere said it's unlikely we regain the highs reached earlier this year any time soon, and any rally above the 2,000 mark on the S&P 500 is unlikely to sustain.

"If you were to see a much stronger demand backdrop (in China), maybe consumption in the Chinese economy really starts to accelerate, then that would be a potentially important catalyst for the market going forward," he said. "From the data we're seeing right now, it's tough to imagine that's going to be the case."