Traders emerging from one of the most turbulent weeks for stocks in history will likely need to brace for more volatility as the Street gears up for next week's jobs report.

While stocks Friday traded within a relatively tight range and ended just around the flatline, the VIX held little changed near 26.

"You can see these futures are being pulled higher with the cash," said Daniel Deming, managing director at KKM Financial. "That indicates there's a fair amount of concern this amount of volatility has that much staying power."

The CBOE Volatility Index (.VIX), widely considered the best gauge of fear in the market, shot above 50 for the first time since February 2009 during the opening plunge in stocks Monday.

The index hit lows for the year of below 12 in mid-July.

"Again, if you have a situation where the VIX is headed to some astronomical number, you're going to see the Fed saying this is not the right time," Deming said.

Ahead of a speech on U.S. inflation Saturday, Fed Vice Chair Stanley Fischer said on CNBC that recent market volatility will affect decision making. However, he emphasized that it is too early to tell if a rate hike will happen in September.

Fischer added in a Saturday speech that inflation pressure in the U.S. economy is likely to rebound and allow for a gradual increase in rates. He and the Bank of England's Governor Mark Carney indicated with their comments that the two central banks could be set to look past recent financial market turmoil set off by fears of slowing China growth.

Read MoreInvestors have been making a mad dash to cash

Analysts are mixed on the primary long-term driver for stocks—either global growth or corporate earnings—but the Federal Reserve is definitely in focus next week. The heavily scrutinized nonfarm payrolls data comes out Friday, the last jobs report before the central bank's September meeting.

The creation of about 220,000 new jobs is expected, up slightly from last month's 215,000 read, according to analysts polled by Thomson Reuters. The forecast for the important wage growth factor shows an increase of 0.2 percent, with unemployment unchanged at 5.3 percent.

"I think the relief of the August employment number is going to have a huge impact on the Fed," said Mark Heppenstall, managing director of Penn Mutual Asset Management. "I think we're probably in a steady state for the employment situation."

He expects a rate hike in September.

A voting member of the Federal Open Market Committee, Richmond Fed President Jeffrey Lacker, is scheduled to speak early Friday, 20 minutes before the jobs report comes out.

Investors will also monitor further developments out of China as global markets continue to weigh concerns of slowing growth in the world's second-largest economy.

Crude oil remains another focal point after rising 20 percent from 6 1/2-year lows hit Monday to settle above $45 a barrel at the end of the week.

Read MoreWhat US and Chinese stocks have in common

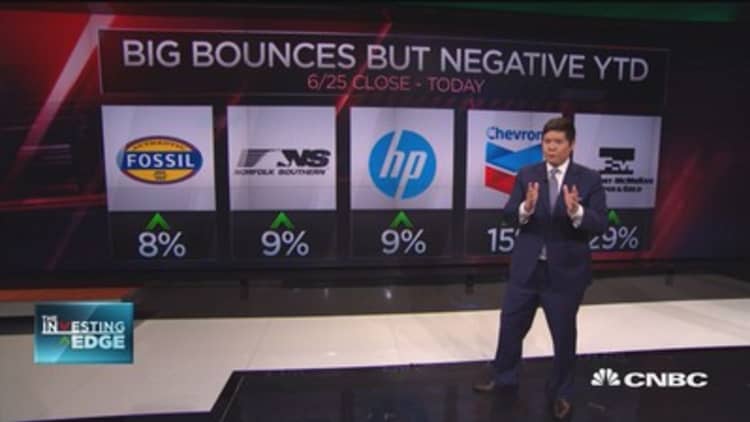

On Friday, the major averages ended nearly 1 percent higher or more for the week in a historic reversal. The Nasdaq Composite swung from lows of off 8.79 percent to gains of 2.6 percent for the week to post a record intraweek reversal. The Dow and S&P 500 also more than recovered sharp losses for their best weekly reversal since 1987 and 2008, respectively.

That stocks could post weekly gains is "a very good sign. It shows you that these pullbacks, even if they're very large, you still have buyers show up in the short term," said Adam Sarhan, CEO of Sarhan Capital. "You had every chance to sell off and move lower this week but right now the market wants to know what the Fed will do but more importantly it wants to (digest volatility)."

Stocks could find it challenging to recover fully from the impact of the recent sharp declines that sent the major averages into correction territory for a few sessions. The Dow Jones industrial average ended the week within 1 percent of correction and remains negative for 2015.

The major averages also remain below key psychological levels in Friday's muted trade, with the Dow closing down about 12 points to 16,643.01 Friday, the S&P 1.2 points higher at 1,988.87, and the Nasdaq up 15.62 points at 4,828.

S&P Capital's Sam Stovall said in a Wednesday note that the S&P 500 faces resistance at 2,092-2,115 and that its "long-term bias will remain negative while below 1,972.50."

"Nerves are a little frayed," said Jeff Powell, managing partner of Polaris Advisors, which has $600 million in assets under management. "Most markets rebound after the second low. Wouldn't be surprised if we retest it next week or the week after."

Powell and other analysts remain confident in the fundamentals of the U.S. market and economy.

Auto sales out Tuesday will also shed light on whether or not consumer spending is continuing to pick up.

Other U.S. data out next week include the ISM manufacturing index on Tuesday, factory orders on Wednesday and international trade figures on Thursday.

Read More Top 5 stocks of the week and how to trade them

In a quiet earnings week, major firms posting results include Dollar Tree and H&R Block on Tuesday, and Medtronic and Campbell Soup on Thursday.

Monday

9:45 a.m.: Chicago purchasing managers index (PMI)

10:30 a.m.: Dallas Federal Reserve manufacturing survey

3 p.m.: Farm prices

Tuesday

Earnings: Dollar Tree, H&R Block, Qihu 360 Tech, Bob Evans

10 a.m.: ISM Manufacturing index, construction spending

1:10 p.m.: Boston Fed President Rosengren speaks on lessons from past tightening cycles

Wednesday

Earnings: Vera Bradley, Five Below

7 a.m.: Mortgage applications

8:15 a.m.: ADP Employment report

8:30 a.m.: Productivity & Costs

8:30 a.m.: Gallup U.S. job creation index

10 a.m.: Factory orders

2 p.m.: Beige Book

Thursday

Earnings: Medtronic, Campbell Soup, Ciena, Joy Global, Lands' End, Cooper Cos.

7:30 a.m.: Challenger Job-Cut report

8:30 a.m.: International trade, jobless claims

10 a.m.: ISM non-manufacturing index

10:30 a.m.: Natural gas inventories

11 a.m.: Oil inventories

9 p.m.: Minneapolis Fed President Kocherlakota speaks at forum in Missoula, Montana.

Friday

8:10 a.m.: Richmond Fed President Lacker speaks on the case against further delay

8:30 a.m.: Nonfarm payrolls

3 p.m.: Treasury Strips