Multinationals have come under fire yet again over their tax arrangements in some European countries, as the continent moves closer to a pan-European regime to combat tax avoidance.

On Friday, European economy and finance ministers and central bankers (known as an ECOFIN meeting) gathered in Luxembourg to discuss what the continent needed to do to create a "fair and level playing field" over the taxation of multinational companies in Europe. Against that backdrop, some corporations have landed in the regulatory crosshairs for their low or no-tax deals with governments.

Read MoreAmazon is in trouble over tax…again

Speaking at a press conference on Friday following the latest ECOFIN meeting, Pierre Moscovici, European Commissioner for Economic and Financial Affairs, Taxation and Customs, said progress needed to made to combat tax avoidance in Europe.

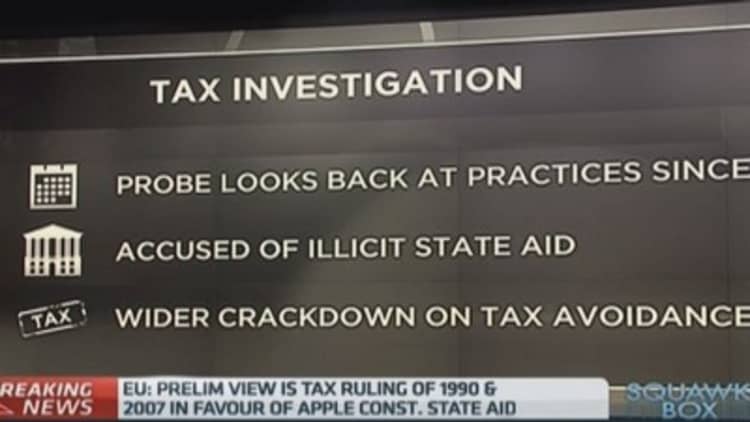

The Commission has already launched in-depth tax probes into large companies they suspect of trying to avoid paying tax. In June, the commission said EU tax probes on the low-tax arrangements—or "sweetheart deals" as they're known—of Apple, Amazon and Starbucks in some member states were at an "advanced stage."

"We are all aware that certain multinationals pay little or no tax on the vast profits that they make here in Europe and this is absolutely unacceptable. That's why we need to ensure that profits generated in the EU are taxed at an appropriate level where the activity takes place," Moscovici told a press conference.

"In the end, it's other businesses—and SMEs (small and medium-sized enterprises) and ordinary citizens who have to pay the price of this tax avoidance, either through higher taxes or public spending cuts," the official added.

The European Commission launched an "action plan" on corporate taxation, one of the body's most highly-publicised bugbears and a priority for the body. In March, the Commission called for the automatic exchange of information on tax rulings between European countries.

Moscovici said on Friday he hoped a solid deal on such an exchange could be reached before the next ECOFIN meeting on October 6.

The commission also plans to re-launch its proposal for a Common Consolidated Corporate Tax Base (CCCTB), a single set of rules that companies operating in the EU could use to calculate their taxable profits.

The move could prove controversial, however, and some member states and business groups have already stated their opposition to a pan-European tax regime. In terms of domestic taxation, opponents see it as an attack on competition and autonomy.

Ireland, which for years has benefited from rock-bottom corporate tax rates that are a draw for multinationals, has strongly opposed the idea of tax harmonization.

Moscovici told the press conference on the matter Friday that CCCTB was a "very important tool if we want to address the issue of effective taxation."

Read MoreApple's EU tax problems: What you need to know

European regulators have launched "in-depth" investigations centered on Luxembourg's tax rulings for online retailer Amazon and Italian car finance group Fiat Finance and Trade. Additionally, coffee chain Starbucks' deal with the Netherlands, and Apple's Irish tax arrangements, have figured prominently in their deliberations.

Commission Vice President in charge of competition policy, Joaquín Almunia, has previously said that sweetheart deals could violate laws on state aid, given that the deals act like state subsidies.

"Under the EU's state aid rules, national authorities cannot take measures allowing certain companies to pay less tax than they should if the tax rules of the Member State were applied in a fair and non-discriminatory way," Almunia said.

- By CNBC's Holly Ellyatt, follow her on Twitter @HollyEllyatt. Follow us on Twitter: @CNBCWorld