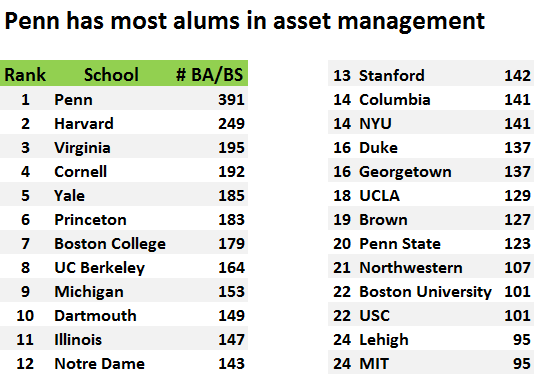

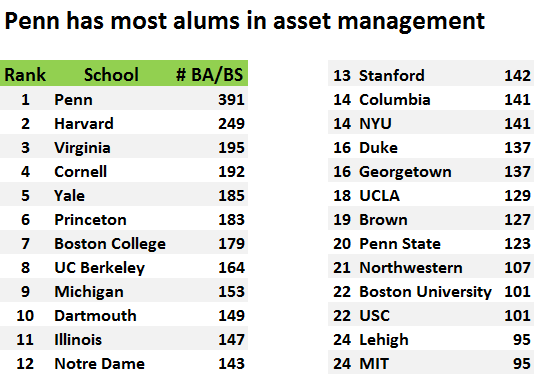

That's according to data provided to CNBC by eVestment. Counting alums with bachelor degrees, Penn has more graduates working in asset management than any other school.

The report is based on a data set of 35,000 active financial professionals from 900 universities and colleges around the world and now working at 4,500 firms. These asset managers voluntarily report the information to eVestment.

The financial analytics firm believes the report is "an invaluable resource" for current and prospective students looking to start a career in asset management. It's a way of seeing where their college network may best serve them. The much bigger report, 118 pages in all, goes into all sorts of details, including the type of firms and the geographic locations that have the highest representation by different colleges.

For example, NYU tops the U.S. fixed income category, but Harvard is No. 1 for European equity.

Some of the major school rivalries are highlighted as well, showing that Michigan beats Ohio State, Duke beats University of North Carolina, and Harvard tops Yale.

The most intriguing datapoint from the entire report is the fact that 1 in 7 asset managers have never experienced a single Fed rate hike in their careers. That number will keep growing until the Fed actually does make a move.

Read MoreOne in seven fund managers have never seen a rate hike