Tesla Motors' sales have grown substantially each year, construction of the company's gigafactory in Nevada is ramping up, and it's launched a new business, selling battery packs for industrial and home use.

Tesla's charismatic founder and CEO Elon Musk makes news regularly with plans for commercial space travel, subsonic mass transit and thought on artificial intelligence. James Bond would not stand a chance against him, but can he make Tesla stock a good investment again?

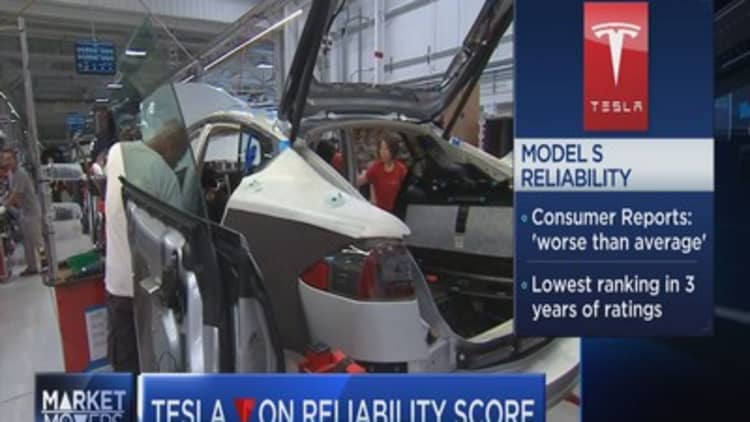

Because Tesla hasn't been lately. Tesla shares are down 20 percent in the past three months — and sure, that's down from a 52-week high of $286. Tesla lost a notable fan in recent weeks when Consumer Reports, which has fawned over the Model S — even called it the best-performing car ever — was forced to remove its "recommended" designation from Tesla due to the growing number of Tesla customer complaints about everything from squeaks and faulty doors to more serious drive system issues.

Tesla shares rallied on Wednesday after its latest earnings, even though third quarter results were short of Wall Street expectations.

Some long-term investors prefer to ignore all the noise — or, in this case, squeaks. Take mutual fund manager Ron Baron of Baron Capital, known for his patient approach to investing. He is a big fan of Tesla and sees a long, prosperous future ahead — and Baron has bet heavily on it. The Baron Focused Fund (BFGFX), Baron Partners Fund (BPTRX) and Baron Opportunity Fund (BIOPX) have all added to Tesla exposure in the past year. Baron wrote to his shareholders last year that in 25 years we will all be driving a Tesla.

Other fund managers share Baron's enthusiasm.

"We see it as a disruptive technology company," said Joe Dennison, an associate portfolio manager at Zevenbergen Capital Investments, which is a sub-advisor on the RidgeWorth Aggressive Growth Stock Fund (SAGAX), of which Tesla makes up 6.2 percent of holdings.

Zevenbergen just launched a retail mutual fund that features the highest exposure of any fund to Tesla stock, the Zevenbergen Genea Fund (ZVGIX), which held 8.6 percent of its assets in Tesla shares at the end of the third quarter.

"It has superior technology and a large lead on competitors. The company has been growing more than 50 percent annually in a market that hasn't been disrupted in about a century," said Dennison, who also personally owns Tesla shares.

Zevenbergen may not be a big fund brand you've heard of, but the biggest fund companies in the U.S. also feature some Tesla fan boys.

"I love it. It's a game-changing company with a huge lead over the competition," said Josh Spencer, portfolio manager at T. Rowe Price's Global Technology Fund (PRGTX), which has 5.4 percent of its $2.5 billion in Tesla stock. "The Model S is the best car on the road, and it was built by what's basically a start-up. As the company hires the best and the brightest, it will continue to out-innovate the competition."

Elon Musk recently took a cheap shot at Apple by saying engineers who fail at Tesla go work for Apple — a Tesla "graveyard," he called it specifically — which has its own ambitions in the electric-car market.

Spencer said BMW, which sells the electric i3 city car and hybrid i8 sports car, is the most credible competitor Tesla faces in the high-end automotive marketplace. "If BMW is the only competitor that can touch you, you're in good shape," Spencer said.

To put Tesla's growth in perspective, total worldwide auto sales topped 80 million last year, while Tesla sold about 32,000 vehicles. That might seem like a blip, but big fund investors noted that provides substantial room for growth. The present drop in gas prices is also unlikely to hurt sales, they said.

"People deciding to buy a Model S or a Model X aren't going to care if gas is $2.50 a gallon or $3.50," Dennison said. "This is part of a large shift to electric vehicles that's in the early innings."

And Dennison added that Tesla's move into the energy storage field, with battery systems for home and industrial applications, will provide additional revenue streams for the company.

Another controversial part of the Tesla story, its use of direct sales — which has been fought by auto dealers and blocked in some places, such as Michigan and Texas — will work for the company in the long term, Spencer said.

"It's a better sales process. You have less inventory sitting around and don't have to worry about dealers with separate agendas. The best parallel is Apple. ... Direct sales have been a great success for them," the T. Rowe Price fund manager said.

Right now distribution is not an issue, because the consumers who really want a Tesla have the resources to pay up, said Morningstar equity strategist Dave Whiston. But Whiston sees several major challenges for Tesla to maintain its stock price — starting with pricing.

Sticking exclusively to direct sales may not work if Tesla wants to expand into the mass market. "There's hype and momentum, but when you look at volume, it's awfully low," he said. Its next model, the Model X SUV, is not likely to be cheaper than the Model S, Musk has said — which has a base price of $70,000–$75,000 — though no specific Model X pricing information has been provided.

A controversial stock price

Tesla's plan to begin production of a lower-cost sedan — the Model 3 — will boost sales volume, Whiston said, but with an expected base price of $35,000, it's still pricier than the average new car. It'll also face competition from electric offerings from mainstream automotive manufacturers, such as General Motors' Chevrolet division's upcoming Bolt EV, which promises a range of more than 200 miles. That's been one of the big differentiators between Tesla and its EV competitors — it's the only one already featuring a battery that has the range of a gas-powered car, at 240 miles on a full charge.

"Tesla is aiming for about 50,000 sales this year and wants 500,000 in 2020, when the gigafactory is fully operational," Whiston said. "But growth is not free. The gigafactory alone will cost $5 billion."

Tesla reported on Tuesday that it had delivered a company record 11,603 vehicles in the third quarter and plans to build between 15,000 and 17,000 vehicles in fourth quarter, and to deliver between 17,000 and 19,000. That would mean 50,000 to 52,000 deliveries for the year.

In its post-earnings conference call on Tuesday, Tesla said it is on track to unveil the Model 3 in late March 2016, and that its gigafactory construction and production are ahead of schedule. The company said its current plans to begin cell production in 2016 for Tesla Energy products at the gigafactory are several quarters ahead of its initial plan.

"There's a lot of potential to change the world here," Whiston said. "But automaking is a cyclical business, and we haven't seen this company go through a recession yet. In a recession, the stock could drop."

Story updated to include Tesla third quarter results, released after the close on Tuesday.

— By Joe D'Allegro, special to CNBC.com