It sounds totally outrageous, but have you ever wondered whether your investment advisor killed a man?

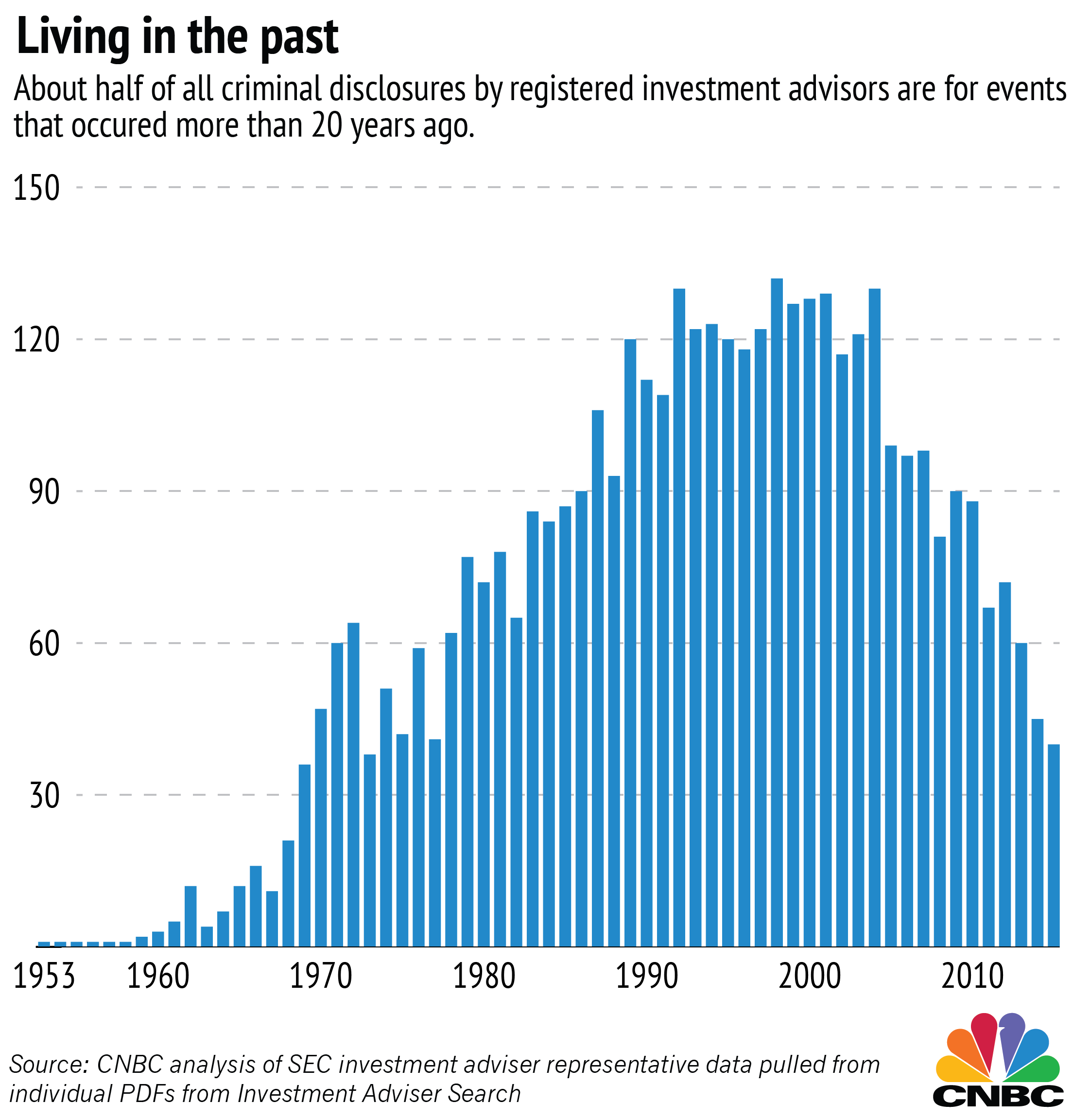

It's not beyond the realm of possibility, and in at least one case, it actually happened. But before you get too alarmed, chances are overwhelmingly high that your financial advisor does not have a criminal past — and if he or she does, statistically it was almost certainly many decades ago.

Investment advisor representatives (the people themselves, not the firms) registered with state agencies are required to disclose their involvement in a wide array of regulatory, disciplinary or criminal actions, and those disclosures are recorded in a massive SEC database covering hundreds of thousands of advisors at firms like Merrill Lynch, Wells Fargo and Morgan Stanley.

About 20 percent of registered investment advisor representatives have some sort of disclosure document on file, and about 2 percent have reported criminal charges like a felony conviction or investment-related misdemeanor, according to a Big Crunch analysis of the data. (CNBC contacted a number of industry groups to weigh in on the data; their responses are expected in coming days).