Despite the astounding surge in the oil supply over the last year, the Bank of England reported that 60 percent of the recent decline in oil prices was due to demand factors.

Cumulative percentage change in the Brent oil price since June 19, 2014, based on 200 commodity price co-Movements

Source: Bank of England November 2015 Inflation Report

The BOE bases this analysis on the co-movement of oil prices with those of other commodities. If oil prices drop simultaneously with other commodity prices, then presumably some common cause is the source. The supply of a range of commodities is unlikely to balloon all at the same time. Therefore, if supply is not the cause, then weak demand is likely to blame.

The BOE cited weaker growth in countries such as China among the reasons for weak demand. (The Paris attacks, as grave as they were, have no immediate, direct and material implications for the oil supply. Syria itself is a minor supplier, and bombing of ISIS in Iraq and Syria are not new, even if their intensity and scope is likely to increase.)

China, directly or indirectly, has been the driver of commodities-demand growth in the last 10 years. Thus, weak global demand implies China's demand must be weak. But here's the problem with that theory: Demand isn't weak. Oil demand year to date is up 6 percent in China, according to China Oil, Gas & Petrochemicals.

And more than that, oil demand globally is posting a stellar year. Over the last quarter, the US Energy Information Administration sees annual global oil demand up 1.3 million barrels per day (mbpd)—a solid performance. Private consultancies put it even higher, with demand up as much as 1.9 million barrels per day. There is no demand weakness as such.

Nor can China's economy be said to be so weak. Official estimates put gross domestic product growth around 6.9 percent for the third quarter, down from 7.7 percent at mid year 2014.

Certainly, this is deceleration, but hardly Armageddon. Of course, unofficial estimates put growth lower, anywhere from 3.5 percent to 5.5 percent. For example, consulting firm Capital Economics estimates China's third-quarter GDP growth at just over 4 percent.

But was this slowdown sufficient to torpedo commodity prices by 35 percent?

China activity proxy and official GDP – percent change year-on-year

Source: Capital Economics

Capital Economics' graph (above) provides a clue to the mystery. Although China's proxy GDP had been trending down since 2011, it took a sharp dive in the second half of 2014. What explains this sudden deterioration?

The Bank of England's analysis suggests that supply and demand were simultaneously afflicting oil prices, and in similar magnitudes. In simple terms, the model suggests that China was collapsing just as an oil-supply surge was tanking oil prices. But how likely are two such momentous events to occur independently within weeks of each other? Not very likely at all.

However, the collapse of oil prices did have a profound impact on China, and for a simple reason: China failed to devalue the yuan. Shale production in the U.S. has enormously improved U.S. terms of trade. The U.S. trade deficit in oil has shrunk dramatically, from $30 billion per month from the dawn of the shale revolution in early 2012, to a mere $6 billion recently.

On an annual basis, the trade-deficit reduction is more than $300 billion, almost 2 percent of GDP. This, in turn, has supported a strong dollar, made even stronger with the collapse in the price of U.S. oil imports last summer. In response, America's key trading partners — the euro zone, Japan and South Korea — all devalued their currencies against the dollar. The euro, for example, has fallen by 22 percent against the dollar in the last 18 months.

Not so for the yuan. China has steadfastly pegged the yuan against the dollar, resulting in a substantial yuan revaluation against the euro, yen and won from summer 2014. This led to substantial loss of China's competitiveness across the globe.

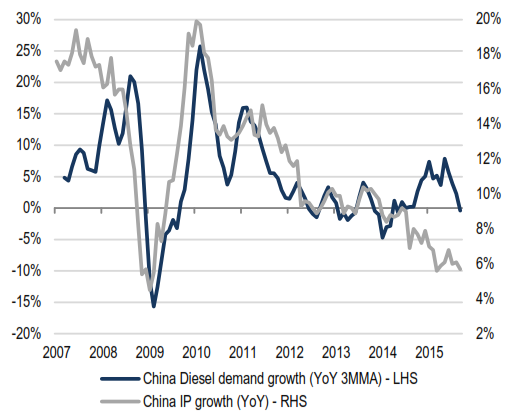

The effects show up quite clearly in industrial production. From 2012 to the first half of 2014, industrial-production growth in China was reported at a steady 9 percent rate. From mid-year 2014, when oil prices collapsed, Chinese industrial production growth also faltered.

By contrast, China's diesel demand, which has historically tracked industrial production, soared. This lends credence to the notion that exchange rates were the principal driver of perceived Chinese economic weakness from mid-2014.

A failure to devalue the yuan made China's oil imports disproportionately cheap, while making China's manufactured exports unnecessarily expensive.

China's diesel-demand growth vs. industrial-production growth

Source: Credit Suisse, using China OGP, CEIC data

By this line of reasoning, therefore, there was no weakness in global demand; rather, there was specific weakness in China's industrial sector — the primary purchaser of global commodities — specifically due to China's failure to devalue the yuan in line with the currencies of other U.S. trading partners.

For oil markets, this interpretation is mostly good news. U.S. terms of trade have probably peaked. U.S. oil production is falling and oil prices are more likely to rise than fall over the medium term. Oil, as a driver of dollar appreciation, is largely played out.

At the same time, China seems to be adjusting to a stronger exchange rate. Capital outflows are easing and China turned a record surplus in the goods trade in September.

The country is showing signs of adapting, and by mid-year 2016, could be back on track even in the absence of yuan devaluation. If so, the Bank of England model suggests demand weakness should ease, and with it, oil prices could rally quite substantially — by as much as $35 per barrel, if the model is to be believed.

I'll confess to some skepticism about all this. From the analyst's perspective, the last year has been all about oil-supply growth. There has been no collapse in demand in any major market. Still, it is hard to explain the broad-based collapse in commodity prices except through demand weakness.

Consequently, we have to give some credence to the Bank of England's model. And if that's so,expect a big rally in oil prices — probably in the second half of 2016.

Commentary by Steven Kopits, managing director, Princeton Energy Advisors.