The White House declined to comment on Pfizer's acquisition of Allergan, the biggest-ever tax inversion deal, but said Congress should take legislative action to prevent deals where companies lower their taxes by reincorporating overseas.

White House spokesman Josh Earnest on Monday told reporters the Treasury Department has tried to discourage tax inversions with a series of administrative actions and said the pace of deals has slowed because of those actions.

Pfizer announced Monday that it would purchase Allergan for $363.63 a share — or about $160 billion — in the biggest deal ever in the health sector. It said it will likely relocate its global headquarters from New York to Ireland, a move that will cut the drug giant's U.S. tax burden.

Inversions, in which firms seek to change their technical tax domicile to one with a lower tax rate by buying a company in another country, have been the subject of political debate for the White House.

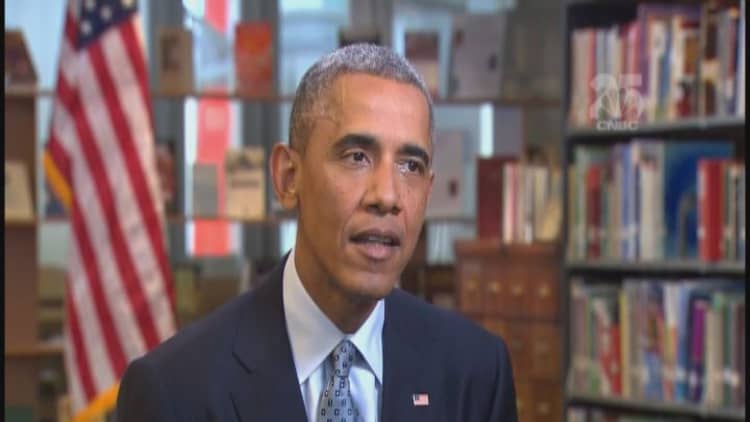

President Barack Obama spoke with CNBC last year on the subject of tax inversions, declaring that those who seek to "game the system" should be stopped.

"You are an American company. You continue to benefit in all kinds of ways from being an American company," the president said. "It is true that there are a lot of things that may be legal that probably aren't the right thing to do by the country."

Obama said during that July 2014 interview that "now is the time" for his administration to tackle corporate tax reform.

He blamed Congress for being "just not real productive," and said his administration had submitted "very specific proposals" on tax reform.

—Reuters and CNBC's Everett Rosenfeld contributed to this report.