AnneMarie Ciccarella needs to find a new health plan for 2016, because her old insurer is out of business. The breast cancer survivor wasn't surprised to find most individual plans don't include her doctors at Memorial Sloan Kettering in their networks.

"I'll give up my oncologist and I will find someone to follow me. And as heartbreaking as that is, I'm going to do it," said Ciccarella, 59, of Glen Head, New York.

What frustrates Ciccarella, who writes about cancer issues on her blog, chemobrainfog.com, is that she can't find a plan that covers her brand-name medications.

She takes Wellbutrin to combat the effects of hormone therapy, and has already had a bad experience with the generic version of the anti-depressant. She may be able to get it from a specialty pharmacy for about $150 a month out of pocket. To keep her post-cancer treatment, Femara said, it could cost her as much as $700 a month.

"The goal of that drug is to keep the cancer at bay — suppress the estrogen. They know my cancer was fed by estrogen," she said, adding that's she's reluctant to go generic. "I don't want to play games with that drug."

This year, close to one-third of mid-range Silver Obamacare exchange plans limit coverage of branded cancer, HIV and other specialty drugs, according to an Avelere health study. That means, patients must pay up to 40 percent of the cost for those drugs out of pocket.

Most employer plans aren't as restrictive, but like narrow doctor networks, brand drug limits are becoming more common. The leading pharmacy benefit management firms, CVS and Express Scripts, which negotiate drug prices for large employers and some insurers, increasingly use their approved drug lists — or formularies — to demand discounts from specialty drug makers.

"As I'm talking to payers across the country — pharmacies used to be an afterthought to them 10 years ago," said Jon Roberts, president of CVS Health's pharmacy benefit management business. "And now, it's probably something that's at the top of their priorities for managing costs."

"If you can actually narrow the networks, you can give bigger discounts. We're constantly balancing access and affordability," said Dr. Steve Miller, chief medical officer at Express Scripts. "If we can't get to the price we need, we're willing to go exclusive, with one company or the other, like we did in hepatitis."

Formulary as a bargaining chip

For the pharmacy benefit managers, or PBMs, the drug formulary has become a potent weapon in price negotiations.

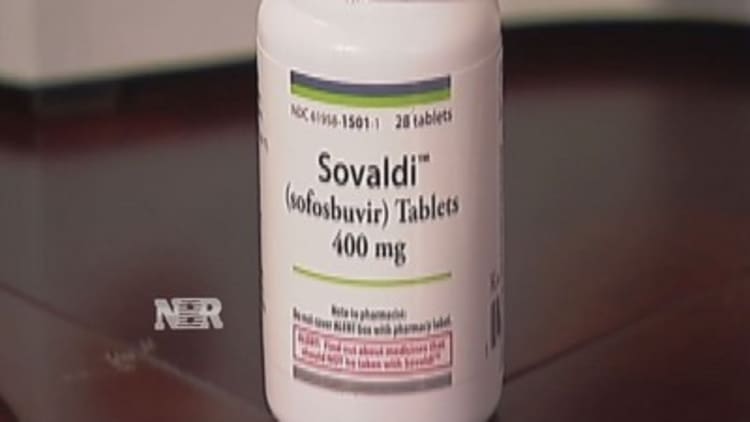

Last year, Express Scripts excluded Gilead's $84,000 hepatitis C drug Sovaldi from its formulary when the drugmaker refused to offer a discount. Now, the nation's largest pharmacy benefit manager exclusively covers the new drug Viekira from AbbVie, because that drugmaker agreed to a big discount. That's worrisome to some in the industry.

"When they start wielding the power and saying 'we're representing this particular product and not representing any of these other products' — before really all the data is in, ... I think that could limit access to the right drug for the right person," said John Malley, AON Hewitt senior vice president and pharmacy practice leader.

The benefit manager firms' decisions carry a lot of weight with customers and other payers. AON Hewitt data show the vast majority of employers who contract with the firms adopt their formulary exclusions.

For 2016, the firms have excluded drugs from pharmaceutical companies such as Valeant and Horizon Pharmaceuticals, which have come under fire for high prices. Both CVS and Express Scripts dropped coverage for Horizon's arthritis treatment Vimovo. Instead, patients will be advised to use a generic prescription that involves taking two pills in combination, at a fraction of the cost.

Physician-turned-pharmaceutical analyst Donald Ellis said switching to a multiple pill regimen could also have its costs, making adherence more difficult.

"What is it worth to take one pill a day? Maybe it's not worth it, but maybe it is worth it," the JMP analyst said. "At the end of the day, who makes that decision? The doctor, the patient, or a PBM or insurer?"

Scott Josephs, Cigna vice president and national medical director, said providers are key, but the most expensive treatment isn't necessarily the best option.

"We all benefit on both the quality and affordability standpoint from the right outcome for the customer," said Josephs, adding that the company is working with doctors to help them understand the dual role of drug formularies. "Now they understand the need to incorporate both quality outcomes and cost outcomes."

Balancing patient needs and costs

Like the drug benefit firms, insurers say they are trying to carry off a difficult balancing act when it comes to high-priced specialty drug formularies.

"They're a small number of our prescriptions, but they're a huge cost driver," said Dr. Edmund Pezalla, national medical director for pharmacy policy and strategy at Aetna. "They take up a very large amount of the budget for pharmaceuticals and they're growing in cost very quickly."

Those costs are helping to push overall premiums higher, said Eileen Wood, vice president of pharmacy and health quality CDPHP, a small New York state not-for-profit insurer. High prices for hepatitis C and new cholesterol drugs on the market are posing a strain on her firm's pharmacy budget.

"That means that for every insured life it's going to cost an additional $7-$9 ( per month) just following the approved labeling from the FDA," she said. "That's 10 percent of the pharmacy cost right there."

Ciccarella understands the need to control costs. She wants to see a better resolution of the current price war, one where patients get a voice at the negotiating table with the payers and pharmaceutical companies.

"Everybody sit there, ... and let's kind of lock the door, throw away the key," she said, "Until somebody comes up with some kind of reasonable answer, nobody leaves the room."

But first, she'll need to find a new health plan, so she'll have some kind of coverage starting in January.