Sometimes an industry can be hated so much that Wall Street becomes blind to anything positive that can occur. When that happens, Jim Cramer knows it is time to break with the consensus and go positive because investors likely are only taking the downside into consideration, ignoring the potential upside.

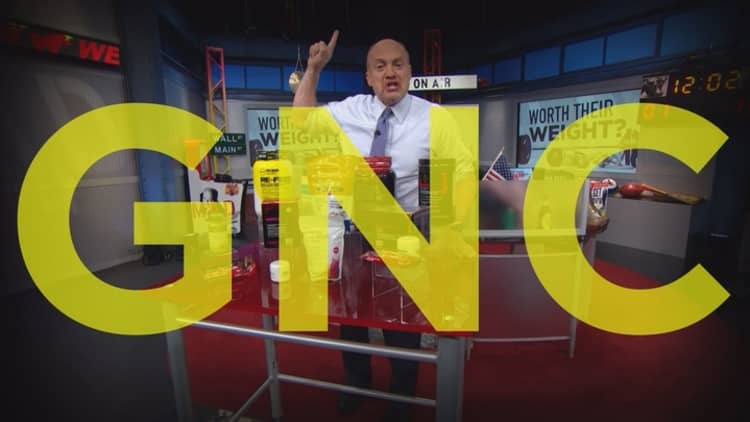

That is why Cramer decided to make a very contrarian call and recommend a vitamin company. Both GNC and Vitamin Shoppe are down significantly for the year, as they have been caught in the crosshairs of the regulators for ages.

But that didn't deter Cramer, especially now that GNC is the cheapest stock in retail, trading at less than 10 times next year's earnings estimates. In fact, he thinks it is too cheap and has been punished enough.

"Right now I think GNC is so cheap with so much going for it, that the stock has become a screaming buy into any end-of-the-year weakness," Cramer said.

Many investors were fretting as they hung on every word of Federal Reserve Chair Janet Yellen's speech on Wednesday, fearing that the Fed might raise rates at its next meeting. But Cramer found that approach to be pointless.

"We can just keep calm and carry on, accept that rate hikes are coming and go to work trying to build a portfolio of stocks that fit your own worldview, regardless of what the Fed does," the "Mad Money" host said.

And while Cramer knows that as a prudent investor he cannot afford to miss a big speech from Yellen, he also knows that he cannot hang on her every word.

"Look, I'm not here to judge what you might have done with your money if you were scared out of the market. I'm here to tell you how to use the endless chatter about the Fed to your advantage," Cramer said. (Tweet This)

Cramer's approach to using the Fed to his advantage is to look at stocks like merchandise on sale at the mall. Every time Yellen confirms that the Fed might actually raise rates, the market sells off. So, think about the stocks that will be most hurt by a rate hike and stocks that sell overseas, because those will be slammed in a sell-off.

Read More Cramer: How to use the Fed to your advantage

Cramer was also elated to see that General Electric is finally getting credit for its major turnaround. The company has taken several steps to transform itself from a largely financial company that made turbines, engines, locomotives and MRIs, back into a fast-growing industrial powerhouse with very little banking exposure, as it has sold off $126 billion in assets from its GE Capital business.

"GE is transforming itself into a leaner, more focused, and easier to analyze company," the "Mad Money" host said.

To find out what could be in store for the future of the company, Cramer spoke with the architect behind the turnaround, Jeff Immelt, GE's chairman and CEO.

With GE's stock as the best performing large-cap industrial in the market, Immelt attributed its success to a combination of the disposition of GE Capital occurring in a fast and valuable way, the spinoff of its credit arm called Synchrony and the fast, organic growth of its industrial business. As a result, people are able to understand the company better.

"When I look at the next three years, the GE team knows exactly what we have to do. We've got all the tools to do it with, and I think from a capital allocation, earnings growth, organic growth standpoint, we are a good bet for investors right now," Immelt said. (Tweet This)

Every time Cramer hears that OPEC is going to get together, as they did last Friday, he hears dozens of stories about how other members of OPEC will put pressure on Saudi Arabia to scale back production.

But with its production running at an all-time high of some 11 billion barrels a day, could that just be a pipe dream?

"Saudi Arabia's minsters aren't likely to be moved, because they are thinking about market share, and so far they really haven't picked up much — least of all in the United States, where they most want it," the "Mad Money" host said.

Cramer thinks this is because in the U.S. it has only been a few weeks where oil output has not increased. Meaning if the Saudis wanted to put a dent into U.S. production in 2015, they failed.

But next year is a different story. This coming year, many oil companies will be far less hedged than before, and the prices they will be hedged against will be much lower.

"2016 will be the year of the credit crunch in the oil industry, especially if crude keeps plummeting like it did today," Cramer said. (Tweet This)

Read More Cramer: Saudi Arabia could crush oil next year

With the ridiculously warm weather wreaking havoc on retail stocks recently, Cramer decided to look for apparel stocks that are doing better than some think.

PVH Corp is the global clothing powerhouse behind brands such as Calvin Klein, Tommy Hilfiger and various legacy brands like Van Heusen and Speedo. PVH reported on Wednesday and the company delivered a 19-cent earnings beat from a $2.47 basis and higher than expected sales.

While the numbers were good, Cramer interpreted the guidance for the next quarter as mixed as the company forecasted weaker than expected earnings but higher than expected sales.

To gain further clarity, Cramer spoke with PVH Corps Chairman and CEO Manny Chirico.

"This is the apparel industry so part of what we deal with is fashion risk; part of what we deal with is the weather and what goes on. Those are things that after 20 years in the business we are used to managing through and I think we did a great job of managing through it in the third quarter, and we will get to in the fourth quarter," Chirico said.

In the Lightning Round, Cramer gave his take on a few caller-favorite stocks:

Nike: "I thought it would have been down more on a conviction buy to buy downgrade from Goldman Sachs, and I think you should wait if you want to buy more. But don't trade around it. It is too good a stock."

CVR Refining LP: "I don't really care for the refiners. I notice that the new MDU Resources refinery with the Calumet specialty is not doing that well, thank you RBN. I don't need you to be in refiners right now."