After a bruising week for commodities, a selection of analysts have told CNBC that the price of oil will see a reversal despite weak fundamentals and a lack of positive sentiment.

David Sneddon, a managing director and global head of technical analysis at Credit Suisse, led the charge for higher oil. He told CNBC Thursday that the current trading range for Brent crude has always been a key support level for the market.

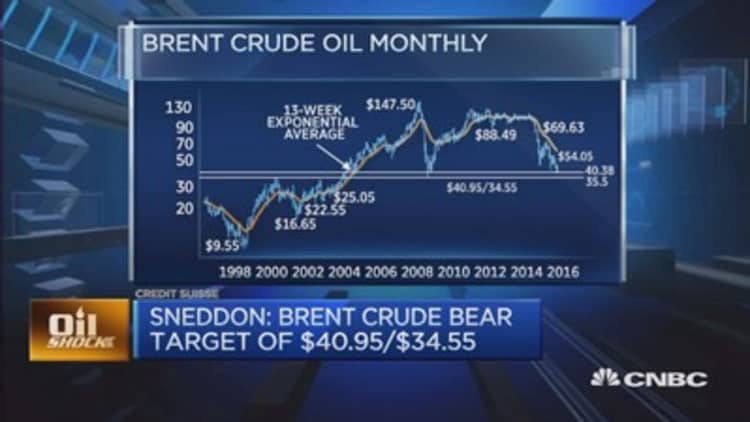

"If you look back over the last 25 years, Brent crude oil has made its major highs and lows in this ($41 to $35 a barrel) area. It was the low in (2008), it was the highs and lows through 2000 to 2004. It was the big high back in 1990 as well," he said.

He added that this current range was typically where "investors come back in," although he conceded that there were actually no buy signals for investors yet.

"(Sentiment) is still bearish but this is the point where we go against the crowd now...this is the zone where we start to look for a reversal," he said.

Bob Parker, a senior advisor at the same Swiss bank, had a similar view. He believes that commodities in general are at "a base" and predicts that Brent crude will trade close to $40 a barrel in the near term and may bounce up to perhaps $45 to $50 a barrel as we go into the second quarter of next year.

Brent crude was on track for its lowest weekly close since 2008 on Friday, according to Reuters, as the International Energy Agency (IEA) warned global oil oversupply could worsen in the new year.

Brent crude futures were down 64 cents at $39.09 a barrel at 11:15 a.m. London time, close to levels not seen since December 2008. U.S. crude futures traded at $36.31 per barrel, down 47 cents.

A lack of unity at an OPEC meeting last Friday caused sharp drops for the price earlier in the week and data showing an unexpected drawdown in U.S. crude stockpiles did little to buffer the fall. Brent crude futures started the week around $42.90 a barrel and have since slipped nearly 9 percent during the week.

Miswin Mahesh, an oil analyst at Barclays, told CNBC Friday that the sentiment is still very much focused and geared towards the downside after the OPEC meeting. However, he believes that output from the oil group is near the "upper bounds" and noted that non-OPEC supply is also predicted to fall next year.

"Things may be not as bad, next year at least, as the market's expecting," he said.

"Next year we have Brent trading between $50 and $60 a barrel and this is essentially to do with the fact that we think the balancing process quickens because of where prices are."