You can be forgiven if statements from the Fed at times sound like a lecture from your least-favorite college subject.

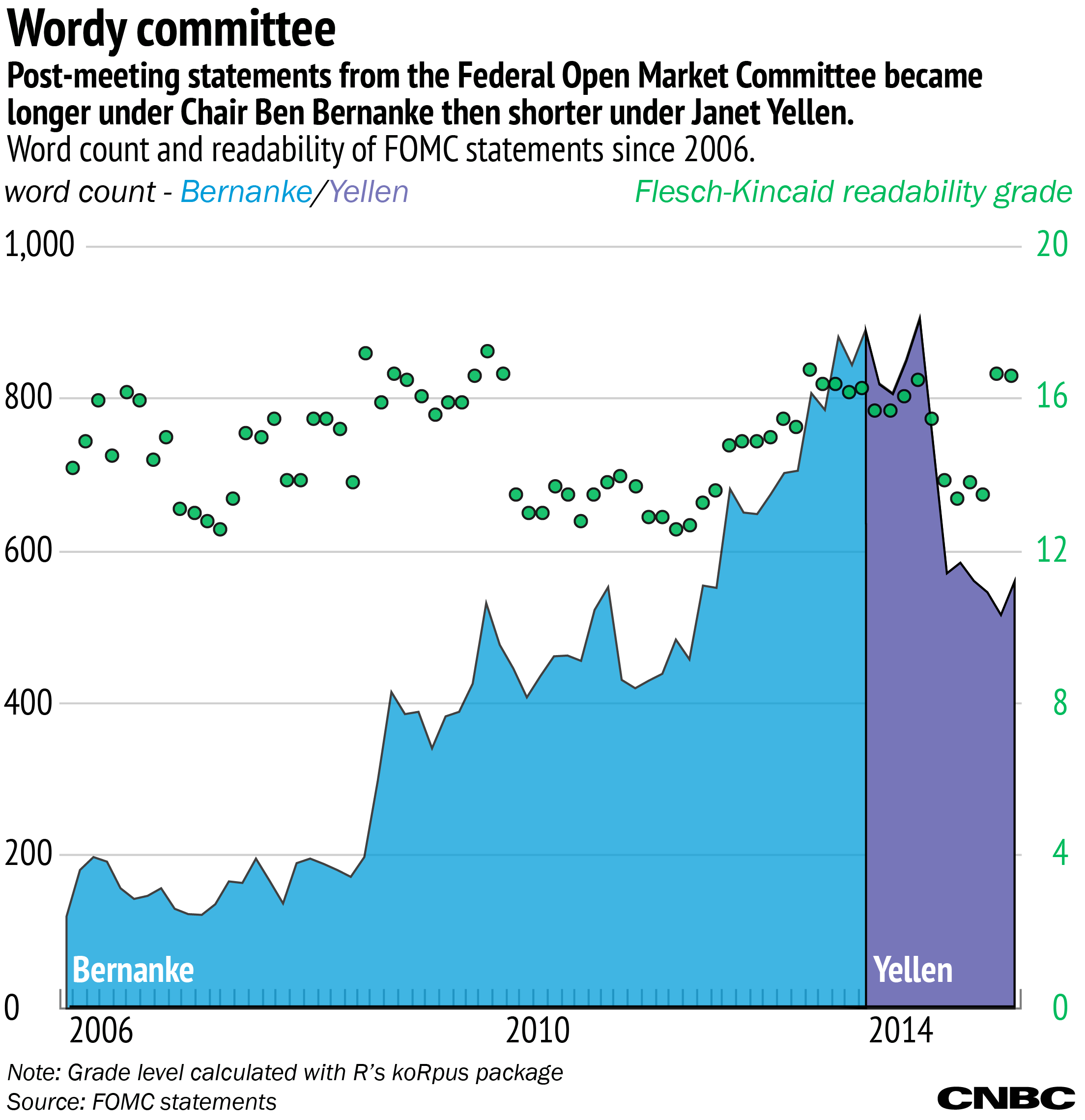

A Big Crunch analysis of statements released by the Federal Open Market Committee following its meetings shows that since Janet Yellen took over as chair, the statements have become shorter but not less complex. We used the Flesch-Kincaid readability scale, a measure of word choice and sentence length, to gauge the complexity of the statements.

The post-meeting statements' length grew steadily through Ben Bernanke's tenure as chair, from under 200 words in 2006 to nearly 900 in his last few months. The FOMC under Yellen continued with the marathon statements, but reduced them after recent meetings to under 600.