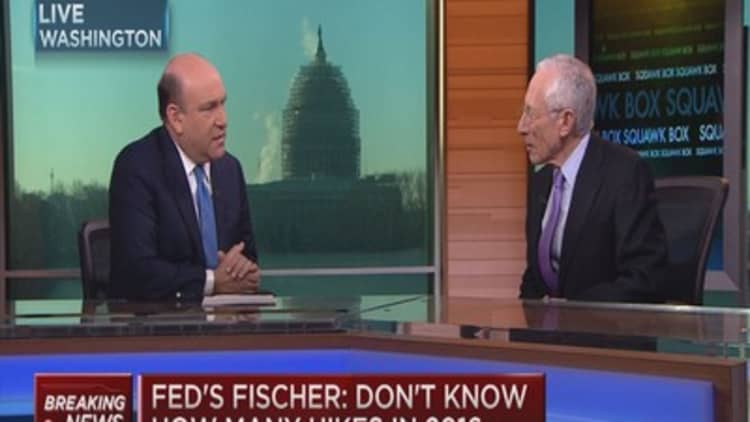

Federal Reserve Vice Chairman Stanley Fischer told CNBC on Wednesday the financial markets are underestimating the trajectory of future interest rates.

"We watch what the market thinks, but we can't be led by what the market thinks," Fischer told CNBC's "Squawk Box." He added that market expectations of the number of future rate hikes are "too low."

According to the December median predictions from central bankers, the Fed may increase rates four more times this year.

Read More Holiday gift: Private job growth surges in Dec

"Those numbers are in the ballpark," Fischer said, but acknowledged the markets could be correct in projecting fewer hikes in 2016, given international uncertainty over North Korea, the Mideast and China.

He said the Fed has a road map, but it plans to react to events as they develop. "We have a goal of 2 percent inflation and 'maximum employment,' which we interpret as the natural rate of unemployment. People think it's somewhere around 5 [percent], possibly a little bit below. That's how we're going to be guided. We want to get there, and we want to get there without creating big messes in the markets."

Even with rates going up, he said the Fed will remain somewhat accommodative while inflation remains below 2 percent. "Those changes are rather subtle."

While North Korea's claim Wednesday to have successfully tested a hydrogen bomb has increased uncertainty in financial markets, Fischer said he's unsure of the long-term impact.

Fischer said concerns about a slowdown in China's economy are perhaps more significant. "For the United States, direct links with China are less important than China's role in the world."

it may be appropriate to lift interest rates further at some point to head off excessively high asset prices.

But a day later, the U.S. stock market started off the new year under serious pressure over international concerns, starting with China's economic slowdown.

The North Korea situation and Saudi Arabia's tensions with Iran over the kingdom's execution of a Shiite cleric were also adding hitting market sentiment.

Read MoreLook out below: Another triple-digit Dow drop ahead

Concern about China's economy and the market fallout in the fall prompted the Fed to hold off on increasing rates at its September meeting.

But the Fed saw those risks easing and U.S. economic prospects looking up, so policymakers increased short-term rates at their December meeting, the first such move in more than nine years.

The minutes from last month's gathering are set to be released Wednesday afternoon.

In the CNBC interview Wednesday, Fischer also addressed the ever declining price of oil as it relates to inflation.

"The continuing declines in the price of oil are quite important in the overall price index," he stressed. "[But] taking account of the exchange rate, and the price of oil and food, we'd be at about 1.4 percent now." He said that's getting close to the Fed's target.

"As oil stabilizes — and it will stabilize one day and it'll even go up one day — we'll see this trend beginning to turn," Fischer said. "My confidence is that those declines in oil and the appreciation of the dollar [are] not going to go on forever, or very long."

— Reuters contributed to this report.