This is breaking news. Please check back for updates.

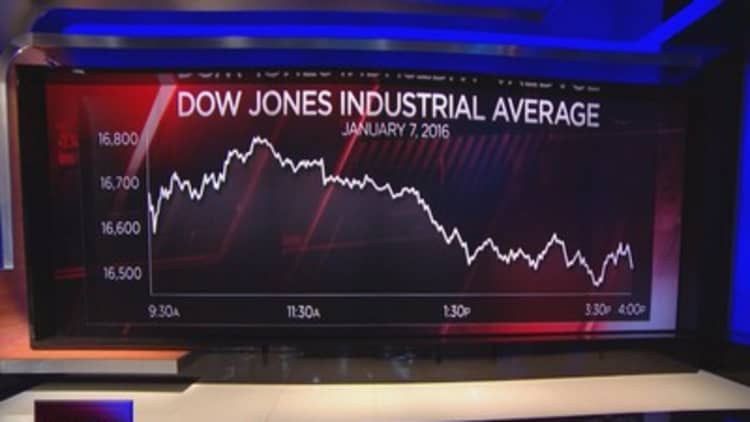

After a tough day of trading that saw the Dow and the Nasdaq fall into a sharp correction, U.S. futures showed modest upside Thursday night as China posted gains in its early Friday trading. (U.S. stock index futures latest)

Global markets were always likely to take their cues from China, which has roiled the financial landscape this week after two circuit-breaker halts to equities trading. The country's major indexes opened their Friday trading more than 2 percent higher, wavered briefly, and then held onto their gains, which may give a strong boost to beaten-down U.S. markets.

Japan's Nikkei moved positive on the day and South Korea'a KOSPI was roughly flat. Here's how Asia moved Thursday evening (U.S.-time).

Asia's largest economy announced Thursday that it had suspended its recently implemented circuit-breaker system, which had kicked earlier, allowing just 29 minutes of trading for the day.

The China Securities Regulatory Commission has used the halts and other measures to control downward pressure amid volatility. However, some observers felt the system as designed could have increased investor jitters about the health of markets. With that system now gone, many are looking to the Chinese government for hints about the future.

"Especially after such a vicious sell-off in the past three to four trading days, I think we have to see some signs of stabilization, but importantly we have to get some sort of announcement from Beijing on what the next steps might be," Jing Ulrich, JPMorgan Chase's vice chairman of Asia Pacific, told CNBC. "They need to reassure the market: The market has lost some money, but they've also lost some confidence."

Traders are also eyeing China's currency: The country's central bank has recently accelerated the depreciation of the yuan, which contributed to Thursday's global stock market sell-off due to concerns this could trigger competitive currency devaluations.

On Friday, the People's Bank of China set the yuan's midpoint rate at 6.5636 per dollar prior to market open, firmer than the previous fix of 6.5646, and firmer than the previous day's closing quote of 6.5929. That marked the first time the PBOC has firmed the midpoint against the dollar in 9 trading days, after it allowed the biggest fall in the yuan in five months on Thursday.

Most outside traders consider the yuan to be more than 10 percent overvalued against the U.S. dollar, experts told CNBC, but allowing the market to take the exchange rate to that rate could potentially devastate China's domestic economy. Still, the PBOC would have an expensive — and potentially impossible — task ahead of it if it wanted to fight the market.

Japanese Finance Minister Taro Aso said Friday that China may find it difficult to continue buying its own currency, given the pace of decline in its foreign currency reserves. But, he added, it is up to China to decide what to do about its currency policy.

China's foreign exchange reserves, the world's largest, posted their biggest annual drop on record in 2015, data showed yesterday.

—Reuters and CNBC's Jacob Pramuk contributed to this report.