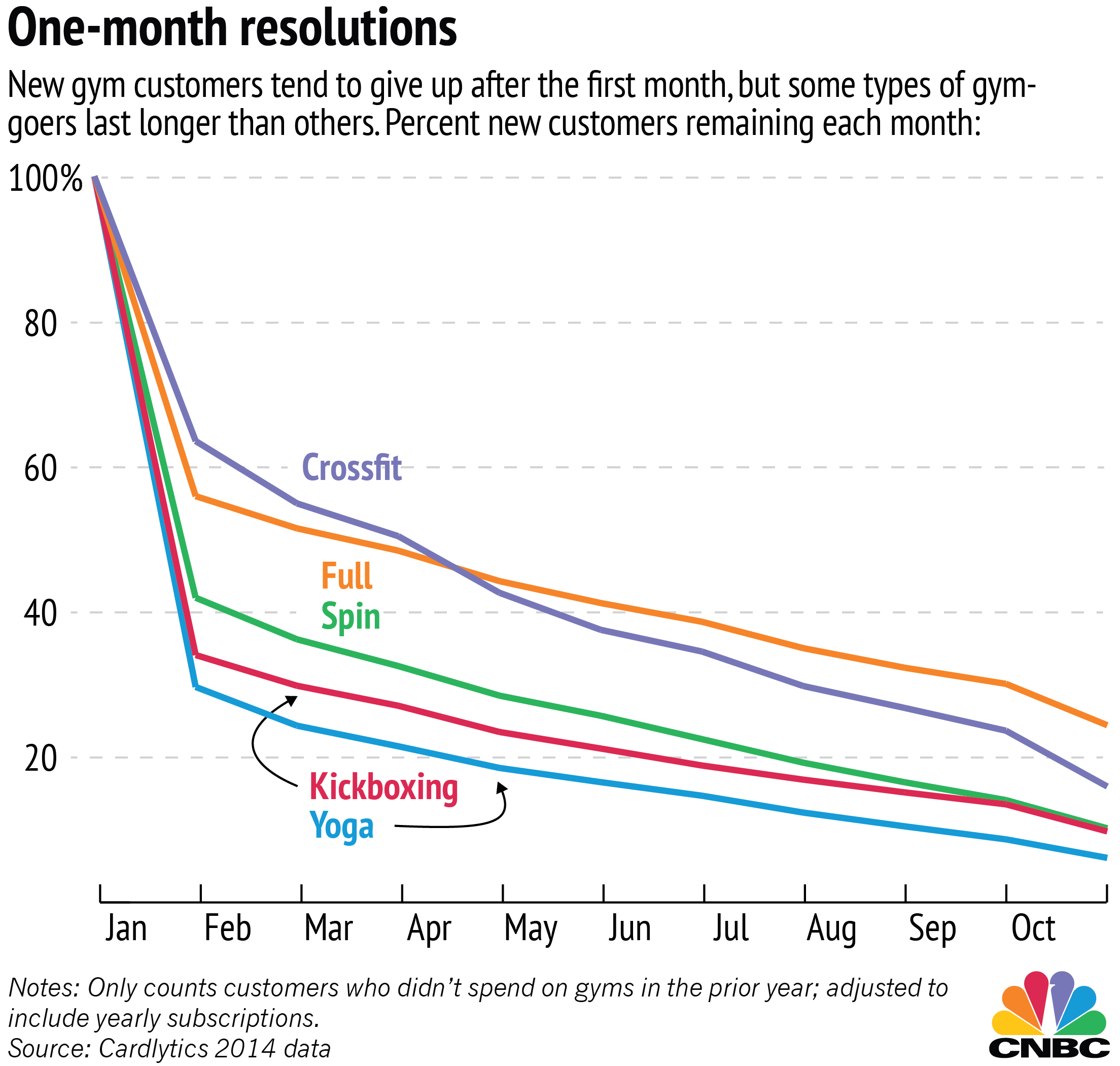

The extreme fitness craze has both ardent enthusiasts and its share of detractors. However, proponents swear by its benefits.

"It's the culture and the sense of community," said Ian Albert, manager of CrossFit Concrete Jungle in New York City. "CrossFit gyms hold you accountable and will check in on you if you don't show up. It's not a huge membership, so we notice if somebody is not coming in," Albert said.

"CrossFit members have more motivation to show up because of the community, the cheering and high-fiving, and camaraderie," he added. "It's more fun to workout with other people that know you."

Cardlytics' partners include Bank of America and Lloyds Banking Group. The company has transaction data from more than 85 million U.S. bank accounts, allowing it to deliver accurate information to retailers about customer behavior.

These details can be powerful for retailers and advertisers. For example, the company knows that people who sign up for spinning classes are 50 percent less likely to buy fast food, as compared to the average gym-goer.

This kind of information helps companies decide which customers are worth marketing toward, and what strategies would be best. It wouldn't be the best idea to pay for an ad offering a 2-for-1 discount on cheeseburgers to somebody who spins. That would be the wrong audience.

The best performance overall comes from the mass market, big-box gyms now often described "Globo Gyms" — a reference to the movie "Dodgeball."

One publicly traded example is Planet Fitness. Even if the numbers are relatively low, these gyms can bring in the most customers by the end of the year, as compared to other gym types.