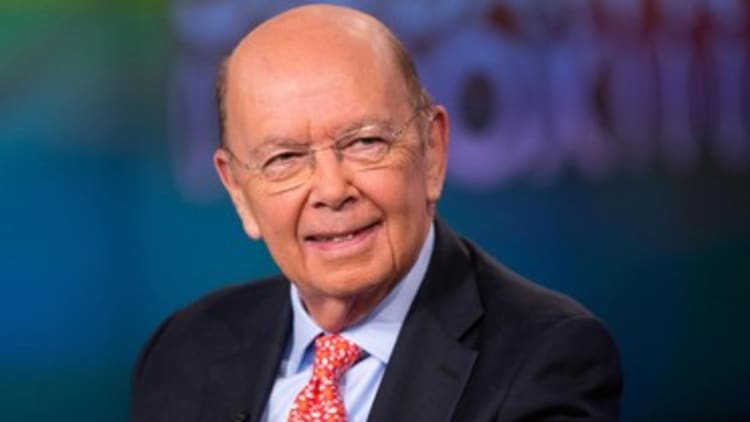

Struggling metals giant Alcoa is doing a "very good job" managing through the difficult world economic environment and the slump in commodities prices, billionaire vulture investor Wilbur Ross told CNBC on Monday.

While encouraged by Alcoa's execution, Ross said he's not a buyer of the stock yet, "because they have a couple of bad quarters to get through."

"[But] Alcoa is adjusting to [China] because they made this big move into titanium and other different metals," the chairman and CEO of WL Ross & Co. said in a "Squawk Box" in an interview. "That's why they're doing the split-up." Aloca plans this year to divide itself into two publicly traded entities, acknowledging that its legacy aluminum operations, and higher-value automotive and aerospace businesses were diverging and no longer compatible.

"Chances are there's more value in the newer things that they've been doing than there was in the old stuff because China is exporting an awful lot of aluminum," Ross said. "And it's a real problem for everybody. The price is down 25 percent in a very short time period. But commodities don't go to zero. Eventually they stabilize at something above the margin cost of production."

Read MoreChina shares tumble in late trade as Asia markets sell off

Shares of Alcoa, a former Dow component, have lost nearly half their value in the past 12 months. The company is set to report quarterly results Monday afternoon.

Alcoa has won a $1.5 billion supply contract from General Electric's aviation unit. Under the deal, Alcoa will supply advanced nickel-based superalloy, titanium and aluminum components for a broad range of GE Aviation engine programs.