Concerns about the stalling Chinese economy, which have punished stock prices around the world in 2016, won't cause a U.S. recession, said Roger Altman, founder of investment banking advisory firm Evercore Partners.

"The chances of a U.S. recession are quite low," he told CNBC's "Squawk Box," citing internal Evercore odds of about 20 percent. "It's not the likely scenario at all."

Altman was not as optimistic about the U.S. stock market. "It's probably going to be a difficult year for equities because most of the juice has been squeezed out of the corporate-profits lemon." He expects revenue growth of 1 percent and profit growth of 3 percent for American companies this year.

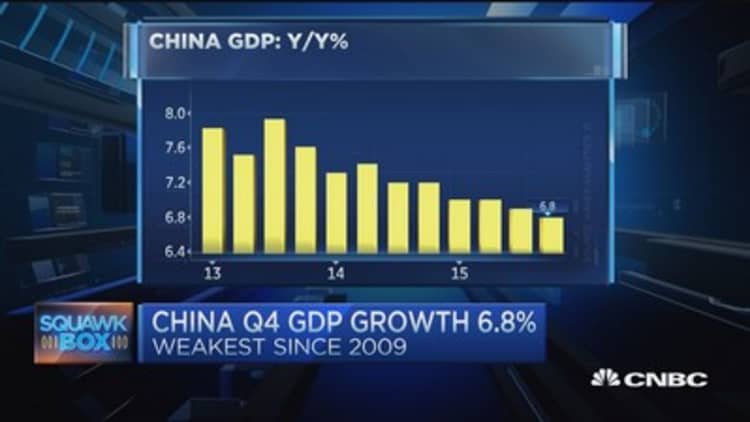

China's economic downdraft certainly won't help. The growth rate there slowed to a 25-year low of 6.9 percent in 2015. While the data did match estimates, Altman said investors have little confidence the numbers reflect the real story, as China looks to transition from a manufacturing- and investment-led economy to a consumer-driven and services model.

"The Chinese, I think, are going back for the moment to a 'brute-force investment' approach to growth," said Altman, a deputy Treasury secretary in the administration of President Bill Clinton.

Billionaire distressed asset investor Wilbur Ross, appearing on "Squawk Box" with Altman, said, "The real growth, in the sense of real material economy, is probably down around 4 percent."

"[The] reason is that if you look at physical indicators — rail car loadings, truck loadings, cement consumption, steel consumption, exports, natural gas consumption and electric consumption — none of those are consistent with … 6.9 [percent]," said the chairman and CEO of WL Ross & Co.

Ross agreed with Altman who said Chinese economic and monetary authorities "have done themselves no favors" in recent weeks. Altman described the confusing message as a "stop-and-go, lurching, now-you-see-it-now-you-don't management of markets. "

Financial markets can deal with good news and bad news but not uncertainty, said Ross, noting how Chinese officials were forced to suspend volatility circuit breakers on Jan. 7 just days after they were implemented. Investors clamored for the move after the circuit breakers shut down trading in two sessions during the first week of 2016.