BP investors might as well be playing in the casino, especially after its latest earnings report, CNBC's Jim Cramer said Tuesday.

"BP turns out to be a dice roll in oil. Who would have thought of that [CEO Bob] Dudley had put together a company that I thought wasn't nearly as levered to the daily price of oil. Literally, that's red-black roulette. Black, oil goes up, BP does well. Red, oil goes down, BP is a disaster," Cramer said on "Squawk on the Street."

BP did not immediately respond to a CNBC request for comment.

The oil giant reported Tuesday its largest annual loss in 20 years in its fourth-quarter results that were well below expectations.

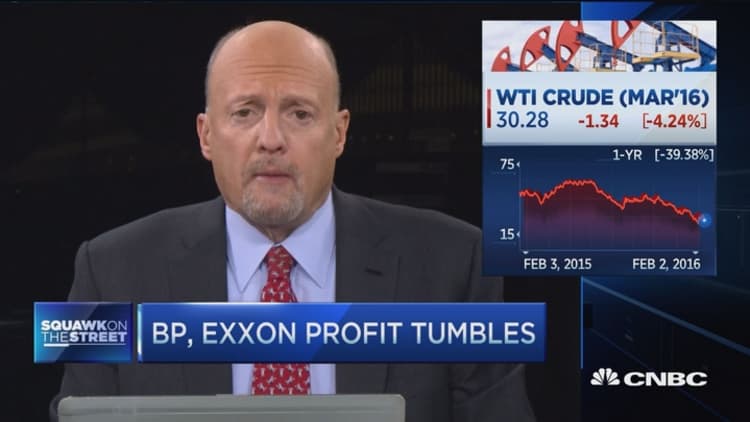

Crude prices around the world were under pressure once again Tuesday, with WTI around $30 a barrel and Brent down nearly 5 percent.

"We will keep the capital frame under review as we move through 2016 and beyond," Brian Gilvary, BP chief financial officer, said in a statement. "Should current conditions persist for longer than anticipated, we expect that all the actions we are taking will capture more deflation and so drive the point at which we balance our organic sources and uses of cash lower than the $60 per barrel that we indicated at last quarter's results."

"What is BP doing? It was almost a fantasy world," Cramer said. "The futures curve shows you that, out nine years, you're getting oil at $45-$46. Whoever came up with that number, that's like saying 'listen, as long as newspapers stay strong, we're going to kill it because we're in the newspaper business.'"

BP's U.S. listed shares were down more than 8 percent in midmorning trading.

ExxonMobil, another giant within the energy space, also reported quarterly results Tuesday, beating expectations on both earnings per share and revenue.

"I like Exxon. I always disliked Exxon when oil was going up because it is not predicated on the price of oil. It is predicated on a long-term production stream. When you have a long-term production stream, and it's not at all in trouble or questioned … then you have the bank of oil, which is what Exxon is," Cramer said.

DISCLOSURE: Cramer's trust does not own BP or ExxonMobil shares.