European stocks slid to close sharply lower as investors remained pessimistic on global economic growth prospects.

The pan-European STOXX 600 came off session lows, but closed down 1.6 percent provisionally, with most sectors finishing lower.

The DAX was slipped to close 1.1 percent lower, after December German industrial output fell 1.2 percent month-on-month, according to the country's Economy Ministry. London's FTSE was off 1 percent, while France's CAC 40 ended down 1.7 percent.

The pan-European FTSEurofirst 300, which slumped 3.4 percent on Monday, traded down as much as 2.1 percent during Tuesday's session, its lowest level since September 2013. It closed 1.4 percent down on Tuesday.

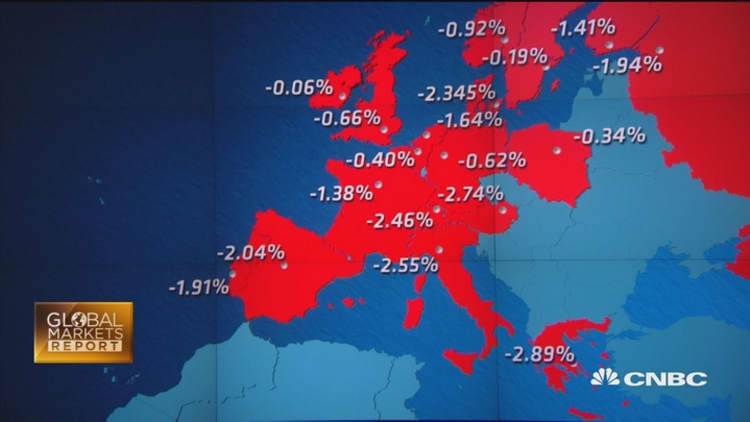

European markets

Monday's sharp sell-off in Europe and the U.S. drove negative sentiment in Asia on Tuesday, where stocks in Australia and Japan fell to close sharply lower. with the Nikkei 225 tumbling 5.4 percent.

As investors looked for cover in safe-haven assets, the yield on 10-year Japanese government bonds (JGB) fell into negative territory for the first time.

"The catalyst appeared to come from the European banking sector as screens flashed red across the board in scenes of total carnage, with equity markets selling off hard across the board over concerns about the future profitability of the whole sector, in an era where interest rates look set to go further into negative territory," Michael Hewson, chief market analyst at CMC Markets, said in a Tuesday note.

European stocks had seesawed in earlier trade, with analysts suggesting Tuesday's initial bounce was due to investors buying on the dip as the broader economy still looks healthy.

"You're getting the capital markets being buffeted from gales from all corners…to our mind, the world economy, the real economy looks in better shape than markets are telling us…that probably is telling us that those with strong constitution will want to add to their developed market equities in particular," William Hobbs, head of investment strategy for Europe at Barclays, told CNBC.

U.S. equities struggled for gains on Tuesday as investors eyed oil and looked ahead to Fed Chair Janet Yellen's testimony.

European banks remain under pressure

The banking sector was once again in focus for investors, with the sector finishing 4 percent down. The chief executive of Swedish bank Swedbank has been ousted from his post with immediate effect. In a statement, the lender said that "it is time for new leadership and a new CEO who can take Swedbank to the next level". The news sent shares to close 5.7 percent lower.

And the Italian banking sector, which has been plagued by concerns over bad loans, continued to come under pressure. Shares in Banca Popolare di Milano tanked over 8 percent, despite reporting a 24 percent rise in net profits last year. UBI Banca also slid 8.9 percent at the close.

Deutsche Bank co-CEO John Cryan rushed to reassure investors on the bank's stability Tuesday, saying in a letter than the lender remained "absolutely rock-solid". Shares, however, slipped over 4 percent.

Miners hammered

Basic resources was the worst performing sector, closing over 5 percent on Tuesday, as a number of factors weighed on sentiment.

On Monday, Goldman Sachs cut its price forecast for a number of metals, blaming weak Chinese and global demand. In addition, Mark Cutifani, the boss of Anglo American, said that metal prices could fall further before recovering. This, together with concerns over the health of the Chinese economy put pressure on mining stocks.

Anglo American ended as one of Europe's worst performers, off over 11 percent, while ArcelorMittal and Glencore were down 10.8 and 8.1 percent respectively.

Oil prices fluctuated on Tuesday, after the IEA cast doubt over oil's recovery, saying global oil demand growth was forecast to "ease back considerably" in 2016 to 1.2 million barrels a day. Brent crude slipped over 2 percent, last trading at $32.04, while U.S. crude hovered around $29.50 a barrel.

Vestas wind surges

In the luxury space, Danish jeweler Pandora said it expected to see slower revenue growth this year. Shares tumbled over 7 percent as a result, despite the firm announcing a new share buyback programme for 2016.

Shares in Porsche closed down 3.4 percent, after its chief executive said the car-maker was bracing for smaller profit gains in the future as Volkswagen's sports-car division steps up spending on models and facilities, according to Reuters.

Denmark's Vestas Wind surged 7.5 percent, making it Europe's best performer, after posting fourth quarter revenue that beat analyst expectations and raised its dividend.