The recent strength in the industrial sector may be a reassuring sign to those worried about the U.S. economy.

Industrial stocks surged more than 3 percent last week, outperforming the broader . The move comes along with a Wednesday report that industrial production increased more than expected in January, jumping 0.9 percent from a month earlier, compared to 0.4 percent estimates.

"Although [industrial production] data can be choppy, the growth in the manufacturing component is a very encouraging sign that the industrial sector may be stabilizing in our view," Lisa Berlin wrote Thursday in a Bank of America Merrill Lynch research report.

This year, market watchers and executives have referred to a potential "industrial recession," spurred by concerns about a slowdown in manufacturing and industrial production. The industrial sector has also served as a proxy for broader economic problems. JPMorgan and Deutsche Bank cited manufacturing last week as a troubling indicator when looking at recession risk.

An industrial recession may be engulfing America

"Seldom is the manufacturing sector in recession and the broader economy is robust," Deutsche Bank's Joseph LaVorgna wrote in a Thursday note, referring to continued concern over manufacturing data.

Slowing global demand, low commodities prices and a strong U.S. dollar have all contributed to the lag in industrial strength. Copper and platinum have both fallen 20 percent over the last year. However, falling commodities prices may be a boon to industrial companies' bottom lines, said Phillip Streible, senior market strategist at RJO Futures.

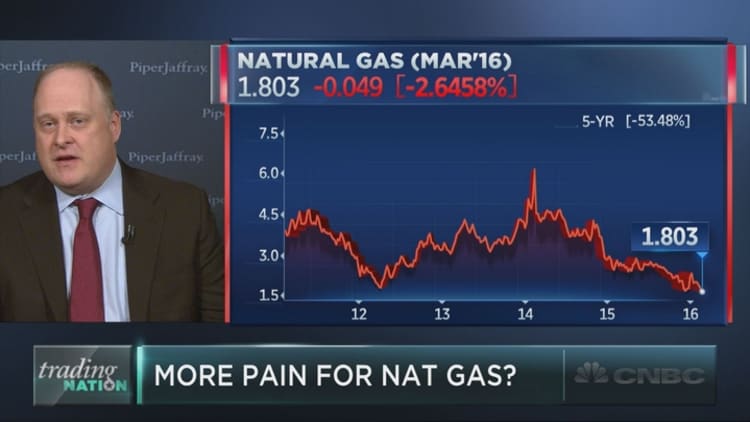

"If you look at their key operating costs, the key drivers are the industrial metals: platinum, palladium, copper and silver. They've all been beaten up severely over the last year and it's a benefit for [companies]," Streible said Friday on CNBC's "Trading Nation."

From a technical perspective, Craig Johnson of Piper Jaffray said the relative performance of industrial names compared to the overall market has taken a major turn.

"You're starting to see this nice turn up in this relative performance. It's caught the eyes of a lot of investors," Johnson said Friday on "Trading Nation." "Some of the true industrial companies are really starting to work."

Within the sector, Johnson pointed to Honeywell, Paccar, 3M, Fastenal, Avery Dennison and Illinois Tool Works as several companies that are starting to see a turnaround.

"If these kinds of stocks are working now, it's a good sign that this economy is not as bad as everybody thinks it is," he said.

Want to be a part of the Trading Nation? If you'd like to call into our live Wednesday show, email your name, number, and a question to TradingNation@cnbc.com.