The U.S. consumer will be in focus Tuesday as Wall Street eyes some related economic reports and earnings. Investors also will watch for indications on oil prices and the path of Fed tightening, with key policymakers scheduled to speak throughout the day.

Jeremy Klein, chief market strategist at FBN Securities, said the consumer confidence figure is most important to him of the reports scheduled for Tuesday.

"If consumer confidence starts to unwind, that could be concerning because now the negative weight from Wall Street is starting to spill over into Main Street," he said.

Consumer confidence for February is due from The Conference Board at 10 a.m. ET. Analysts polled by Reuters expect a 97.3 print, down slightly from January's 98.1 read.

Also at 10 a.m. come January existing home sales, another indication of the strength of consumer demand. The figure is expected to edge lower but hold well above a 5 million seasonally adjusted annual rate. The December Case-Shiller Home Price Index is due for release at 9 a.m.

Oil prices will remain a primary focus for stock market action, especially as Saudi Oil Minister Ali al-Naimi is scheduled to speak at the CERAWeek energy conference Tuesday at 9:50 a.m.

Read More Slow progress bridging America's economic divide

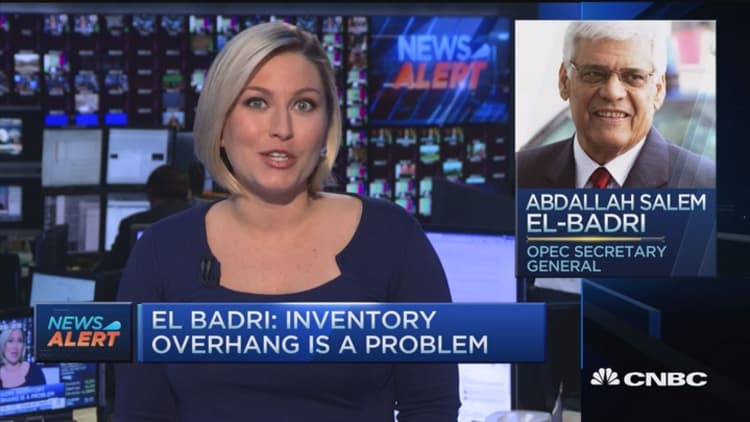

His remarks follow OPEC Secretary General Abdalla Salem El-Badri's comments Monday that the cartel is willing to work with non-OPEC producers to find a solution to low oil prices.

Saudi Arabia led the 2014 switch to market-based pricing, and Naimi's remarks will be key since the kingdom and Russia last week agreed to freeze production at the historically high January levels if other producers joined in.

U.S. crude oil futures for March delivery closed sharply higher at $31.48 a barrel Monday after a report forecasting a drop in U.S. shale oil production this year and next. After the settle, the contract rolled to April, which ended higher at $33.39 a barrel.

Read MoreHow to know markets are out of the woods

Stabilization in oil prices above $30 will likely support overall stock market gains, analysts said.

"As long as you don't slip below $30, that's enough. You're seeing enough signs of commodities decoupling from equities," Klein said. In the last week, stocks have sometimes managed to shake off pressure from oil price declines.

U.S. stocks closed more than 1 percent higher Monday, with the rising 1.45 percent to 1,945.50 as energy led all 10 sectors up. The Dow Jones industrial average jumped 1.4 percent, or 228.67 points, to 16,620.66, just shy of its 50-day moving average which it briefly topped in intraday trading Monday for the first time since late December. The Nasdaq composite closed up 1.47 percent at 4,570.61.

Traders will be watching Tuesday to see if the S&P 500 can top the technically key 1,950 level, which is around the index's 50-day moving average of 1,951.68. Recovery to that level would help solidify the view that Feb. 11 marked a short-term bottom in stocks.

Read MoreThe S&P is closing in on a critical level

Several analysts remain skeptical of the rally and attribute much of it to short covering. Still, the recent gains in stocks have come amid some fundamental developments, including stabilization in China and recent U.S. economic data that have alleviated recent concerns the domestic economy was slipping toward recession.

JPMorgan's preferred macroeconomic indicator for the probability of a recession beginning within 12 months ticked down last week for the first time since the company started publishing weekly updates, on Jan. 22. The indicator, which draws from reports such as consumer sentiment, building permits and auto sales, fell to 31 percent, from 32 percent previously but remains above the historical average of 18 percent, economist Jesse Edgerton said in the note.

The report also said models using corporate bond spreads still "suggest considerably higher recession risk."

"I think the market's still pricing in U.S. recession at this point. We've obviously had a move upwards but I think volatility is here to stay. The question of a recession and the pace of Fed tightening will still persist," said Andrew Lee, deputy head of ultrahigh net worth and alternative investment at UBS Wealth Management.

Tuesday brings three Fed speakers, with Minneapolis Fed President Neel Kashkari due to speak at the St. Paul Regional Economic Development Partnership Winter Investor Meeting in Minneapolis at 9 a.m. ET

Fed Vice Chair Stanley Fischer is scheduled for 8:30 p.m. at CERAWeek on "Developments in Monetary Policy." Earlier this month, Fischer did not specifically state when the central bank would next make a move on rates but said the Fed remains data dependent.

"I think what markets are looking for this week is confirmation that rate rises have been pushed out. … I think anything hawkish right now will not be taken well by the market in the short term," said Sanjeev Lakhani, investment manager at Henderson Global Investors.

Dallas Fed President Rob Kaplan is scheduled to give welcoming remarks at 8:50 a.m. for an event on "Educational Attainment" in Texas.

In earnings news, Home Depot and Macy's are due to report ahead of the opening bell Tuesday, as are Norwegian Cruise Line, Toll Brothers, JM Smucker and Cracker Barrel. Avis Budget, Caesars Entertainment, Dreamworks Animation, Etsy and Popeyes are scheduled to post results after the close.

Read MoreTwo more signs a recession could be coming

Recent consumer earnings reports have disappointed.

Nordstrom last week reported earnings that missed on both the top and bottom line. Its full-year earnings and sales outlook were also below forecasts.

Wal-Mart also gave a softer full-year revenue forecast due to pressure from the strong U.S. dollar.

— CNBC's Patti Domm contributed to this report.