The Shanghai composite bucked a generally downward trend in Asia on Wednesday as major indexes in Australia, Japan, and Hong Kong all fell.

Analysts pointed to a combination of factors that kept investors skittish, including low oil prices, wavering confidence in the ability of central banks to spur growth, weak data, and renewed concerns over China's renminbi.

The gained 26.23 points, or 0.9 percent, to 2,929.56 while the Shenzhen composite was flat at 1,876.47.

The Japanese benchmark index retraced losses over 1.7 percent early on to close down 136.26 points, or 0.85 percent, at 15,915.79. The broader Topix also pared losses of over 1 percent but finished lower 6.64 points, or 0.51 percent, to 1,284.53.

Across the Korean Strait, the Kospi ended near flat at 1,912.53. Hong Kong's closed down 222.33 points, or 1.15 percent, at 19192.45.

Down Under, the S&P/ASX 200 extended losses from Tuesday by closing down 104.56 points, or 2.10 percent, at 4,875.01, with most sectors finishing in the red. The heavily weighted financials sector was down 2.54 percent, energy fell 3.44 percent, and the materials sector sold off 3.62 percent.

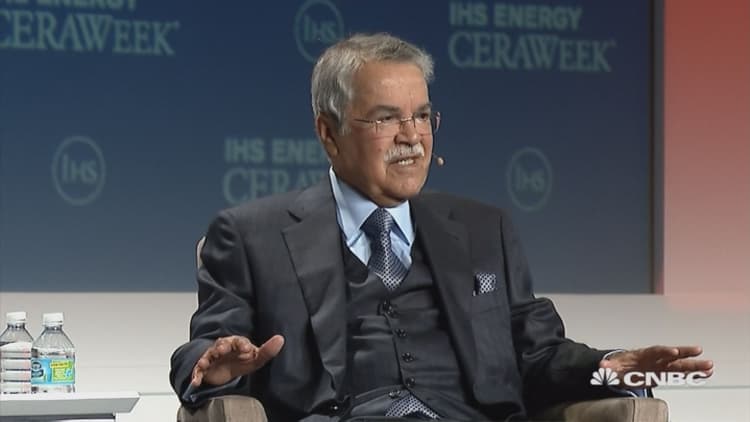

Overnight comments from Saudi Arabia's oil minister, Ali bin Ibrahim Al-Naimi, dashed hopes for a possible production cut to tackle the global supply glut and sent already low oil prices lower still.

"Oil is obviously one of the big swing factors out there," said Andrew Sullivan, managing director for sales trading at Haitong International Securities.

But, Sullivan told CNBC's "Squawk Box", "the other major thing is people are just watching the central banks and fast coming to the conclusion that there's not an awful lot that central banks can do."

"And this move to negative interest rates for a lot of people is actually a bad thing," he added.

Starting Friday, finance ministers and central bank governors from G20 nations will meet for two days in Shanghai to address growing global growth concerns.

Cynthia Kalasopatan from Mizuho Bank cited weak business confidence in Germany and a lower fixing of the Chinese yuan as negative drivers, alongside lower oil prices.

"A weaker CNY fixing for the first time in a few days sparked renewed concerns about the second largest economy in the world," she wrote, in reference to the People Bank of China's (PBOC) Tuesday midpoint fix of the yuan at 6.5273 to the dollar, down 0.17 percent from Monday's fix.

On Wednesday, the PBOC fixed the yuan midpoint at 6.5302 to the dollar. China's central bank lets the yuan spot rate rise or fall a maximum of 2 percent against the dollar, relative to the official fixing rate.

The pair traded at 6.5315 in the afternoon.

The move away from riskier assets to safer grounds saw the Japanese yen strengthen against the dollar, with the dollar/yen pair falling to the 111 handle. The pair traded down 0.14 percent at 111.95 in the afternoon.

In Asian trade, U.S. crude futures were down 1.69 percent at $31.35 a barrel, after settling down 4.55 percent during U.S. trade. Globally traded benchmark Brent futures were down 0.81 percent at $33 as of 3 p.m. HK/SIN time, after falling 4.18 percent overnight.

Energy plays across the region were mostly down with Santos closing down 6.57 percent, Woodside Petroleum declining 2.6 percent, and Inpex falling 1.31 percent. Japan's Fuji Oil was up by 0.36 percent.

Mainland Chinese oil plays ended mostly in positive territory with shares of China Oilfield gaining 1 percent.

Speaking at the IHS CERAWeek energy conference in the United States, the Saudi oil minister said, "Freeze is the beginning of a process, and that means if we can get all the major producers to agree not to add additional balance, then this high inventory we have now will probably decline in due time. It's going to take time."

"It is not like cutting production. That is not going to happen because not many countries are going to deliver even if they say they will cut production — they will not deliver. So there is no sense in wasting our time seeking production cuts," Al-Naimi added.

Last week, Saudi Arabia, Russia, Qatar and Venezuela proposed a freeze that would cap production at January levels, contingent on participation from other oil producers.

Russia's energy minister, Alexander Novak, said on Saturday that the deal should be finalized by March 1, Reuters reported.

But Iran's oil minister Bijan Zangeneh said on Tuesday that the output freeze deal between Saudi Arabia and Russia was "a joke," as reported by Iranian state broadcaster Press TV.

"Some countries that are producing above 10 million barrels per day (bpd) have called on Iran to freeze its production at one million bpd," Zangeneh was quoted saying.

Evan Lucas, market strategist at IG, said in his morning note that oil remained an exciting trading opportunity.

"I see the April contracts in WTI and Brent finishing in the low to mid US$30 a barrel for two reasons," he wrote. "Despite the political storm in OPEC there is a natural demand increase from China leading into the northern summer, and the US is beginning to see rig count declines."

"However, there is record stock piling and the over-production issues will cap the price of oil in a sub-US$40 a barrel range."

Sharp shares finished down 2.79 percent as its board started a two-day meeting on Wednesday to decide on which of the two takeover offers to accept. The troubled Japanese electronics maker has competing offers from Japanese state-backed Innovation Network Corp of Japan and Taiwan's Foxconn, which reportedly is offering Sharp a $5.9 billion takeover offer, according to Reuters.

In Australia, earnings season continued with iron ore producer Fortescue reporting its first-half earnings for the six months ended 31 December, 2015. Net profit was down 4 percent to $319 million on-year. Shares of Fortescue closed down 4.76 percent.

Generally, Australian resource producers were under pressure with the likes of Rio Tinto selling off 5.83 percent and BHP Billion declining 8.22 percent.

Major indexes in the U.S. finished lower with the closing down 188.88 points, or 1.14 percent, at 16,431.78. The S&P 500 closed down 24.23 points, or 1.25 percent, at 1,921.27 while the slipped 67.02 points, or 1.47 percent, to 4,503.58.